Why Is Bitcoin Dropping? 5 Reasons Behind the 2026 Crash

Bitcoin has dropped more than 45% from its October 2025 all time high above $126,000. In the first week of February 2026 alone, BTC briefly plunged below $61,000 before recovering to the $66,000 to $70,000 range. Ethereum, Solana, and virtually every major altcoin followed with even steeper losses.

So what is actually driving this sell off? Here are the five primary factors.

1. Institutional Demand Has Reversed

The same institutional money that fueled Bitcoin's rally is now heading for the exits.

According to data from CryptoQuant, U.S. spot Bitcoin ETFs have become net sellers in 2026 after purchasing 46,000 BTC during the same period last year. Deutsche Bank analysts noted that these ETFs suffered outflows exceeding $3 billion in January 2026, following $7 billion and $2 billion in outflows during November and December 2025 respectively.

This reversal is significant because ETF inflows were a central pillar of the bull case throughout 2024 and early 2025. With that bid disappearing, the price has lost one of its strongest demand sources.

2. The "Digital Gold" Thesis Is Failing

Bitcoin was supposed to be a safe haven. The data tells a different story.

Since October 2025, gold futures have gained over 60% while Bitcoin has fallen roughly 50%. During a period of extreme geopolitical uncertainty, including U.S. tensions with Venezuela and Iran, investors have rotated into traditional safe havens and Treasuries instead of crypto.

Treasury Secretary Scott Bessent made matters worse during congressional testimony when he stated that the Treasury has "no authority to stabilize crypto markets." The message was clear: if Bitcoin falls, the government is not coming to help.

The divergence between gold and BTC has forced a reevaluation among institutional allocators. For many portfolio managers, Bitcoin is now firmly categorized as a risk on asset, not a hedge, and that classification has real consequences for capital flows.

3. Massive Forced Liquidations3

Leverage kills in crypto, and the first week of February was a textbook example.

More than $2 billion in leveraged long and short positions were liquidated in a single week, according to Coinglass data. Futures open interest dropped from $61 billion to $49 billion, representing a 20% decline in leveraged bets within days.

VanEck's head of digital asset research, Matthew Sigel, noted that February 5 registered a negative 6.05 standard deviation move on the rate of change Z score, placing it among the fastest single day crashes in crypto history. When leverage unwinds at this speed, it creates a cascading effect where liquidated positions push prices lower, triggering more liquidations in a feedback loop.

4. Miners Are Selling Under Pressure

Bitcoin miners have been forced to sell BTC to keep operations running.

Many mining companies pivoted toward AI and high performance computing in 2024 and 2025, raising capital on the promise of diversified revenue streams. But with financing conditions tightening alongside falling Bitcoin prices, that strategy has backfired. Miners now face the double burden of weakening BTC revenue and drying up AI investment.

Sigel from VanEck described the dynamic plainly: "As financing conditions tightened alongside Bitcoin weakness, miners faced increased pressure to sell Bitcoin to bolster balance sheets." This selling pressure from miners adds consistent downward force to the market, particularly when prices are already falling.

5. The Four Year Cycle Is Asserting Itself

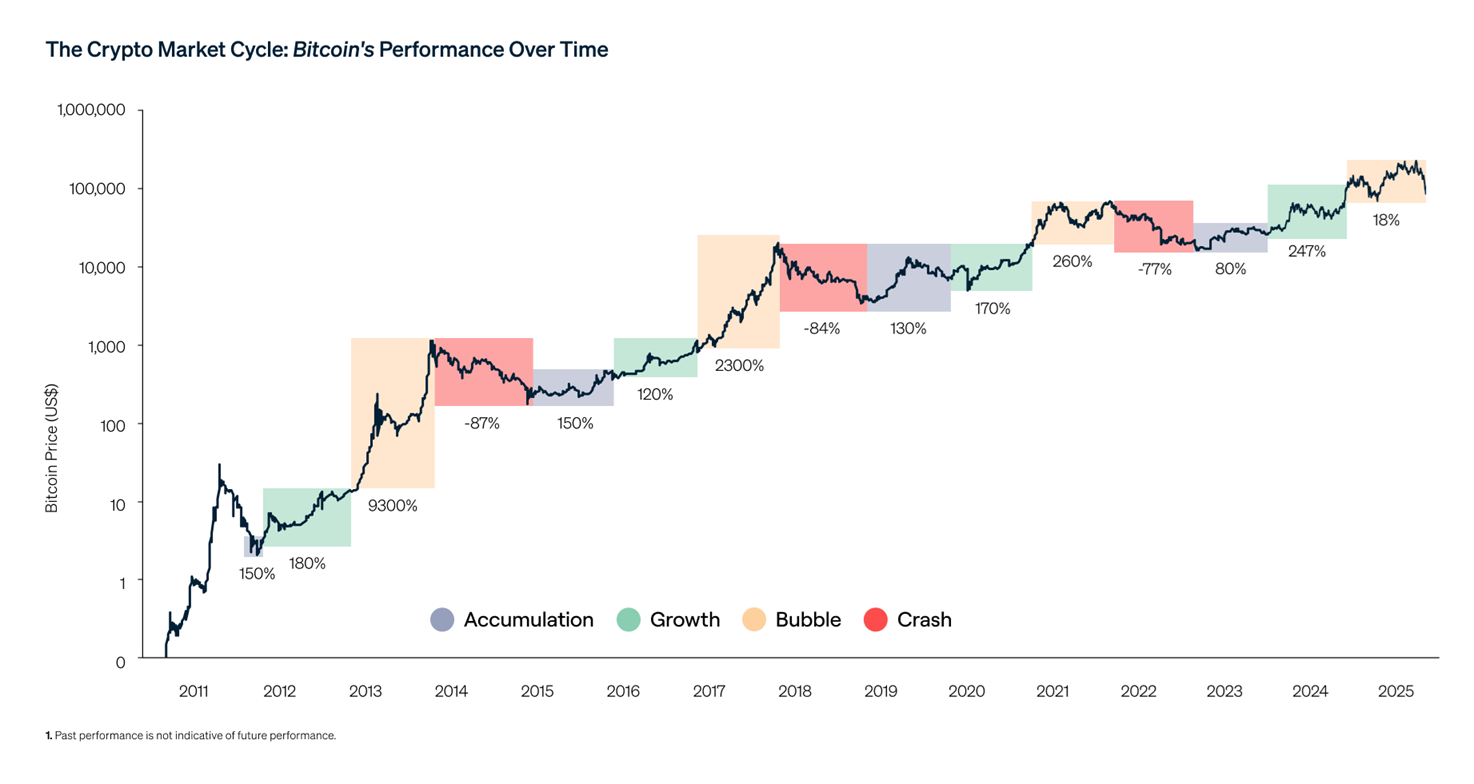

Veteran crypto traders are pointing to a pattern that has repeated in every previous cycle.

Steven McClurg, CEO of Canary Capital, told CNBC: "2026 I expect to be a bear leg to the four year cycle." The theory, based on Bitcoin's halving schedule, suggests that BTC tends to rally in the year following a halving, peak, and then enter a prolonged correction roughly 18 to 24 months later.

If the pattern holds, the current drawdown is not an anomaly. It is exactly what the model predicted. The average peak to trough decline during previous four year bear cycles has been approximately 75%, according to Wolfe Research. If Bitcoin were to experience a correction of that magnitude from its $126,000 high, the bottom would be somewhere near $31,000.

Whether the cycle repeats with the same severity is debatable. The market structure has evolved with the introduction of ETFs, institutional custody, and regulated trading venues. But the underlying psychology of euphoria followed by fear appears to be very much intact.

What Comes Next?

Sell offs of this depth are not new for Bitcoin. Drawdowns exceeding 50% have occurred in 2014, 2018, 2022, and now 2025 to 2026. In each prior instance, Bitcoin eventually recovered and reached new highs, though recovery timelines ranged from one to three years.

Several analysts see the current conditions as late stage stress rather than the beginning of a deeper collapse. VanEck noted that realized volatility at 38% is roughly half the levels seen during the 2022 bear market, suggesting that much of the downside risk has already been absorbed.

The near term outlook depends heavily on macro conditions, ETF flow direction, and whether the $60,000 support level holds on a retest. For now, Bitcoin remains in a volatile range between $65,000 and $72,000, with the market waiting for its next catalyst.

The question every trader is asking is not whether Bitcoin will recover. It always has. The question is how much lower it goes first.

This article is for informational purposes only and does not constitute financial advice. Always do your own research.