What Is Solana? The Fastest Blockchain Explained in Plain English

Speed, scale, and a blockchain built for the real world.

Solana processes thousands of transactions every second. Fees cost fractions of a penny. The network runs 24 hours a day, 365 days a year. And yet most people still cannot explain what makes it different from Ethereum or why it matters.

Here is the problem. Every "What Is Solana" article either buries you in developer jargon or gives you a paragraph and moves on to price predictions. Neither approach helps you actually understand the technology.

This guide fixes that. You will learn what Solana is, how Proof of History works, what the SOL token does, where the ecosystem stands in 2026, what risks exist, and how to decide if it deserves a place in your portfolio. No filler. No hype. Just the information you need.

What Is Solana in Simple Terms?

Solana is a Layer 1 blockchain designed for speed and scale, using a unique timekeeping system called Proof of History to process transactions faster and cheaper than nearly every other network.

Like Ethereum, Solana supports smart contracts, decentralized applications (dApps), tokens, and NFTs. The difference is architecture. While Ethereum processes roughly 15 to 30 transactions per second on its base layer, Solana handles thousands. While Ethereum gas fees can spike to dollars during congestion, Solana fees typically stay below one cent.

Solana launched on March 16, 2020. The network was created by Anatoly Yakovenko, a former engineer at Qualcomm and Dropbox. He designed Solana to solve a problem he saw across every existing blockchain: they were too slow to support real world financial applications at scale.

The core innovation is Proof of History. It gives the network a built in clock that timestamps every transaction before it reaches consensus. This eliminates a massive bottleneck that slows down other blockchains.

As of February 2026, Solana ranks #7 by market capitalization at approximately $48 billion, with SOL trading around $85 and a circulating supply of roughly 568 million tokens.

How Does Proof of History Work?

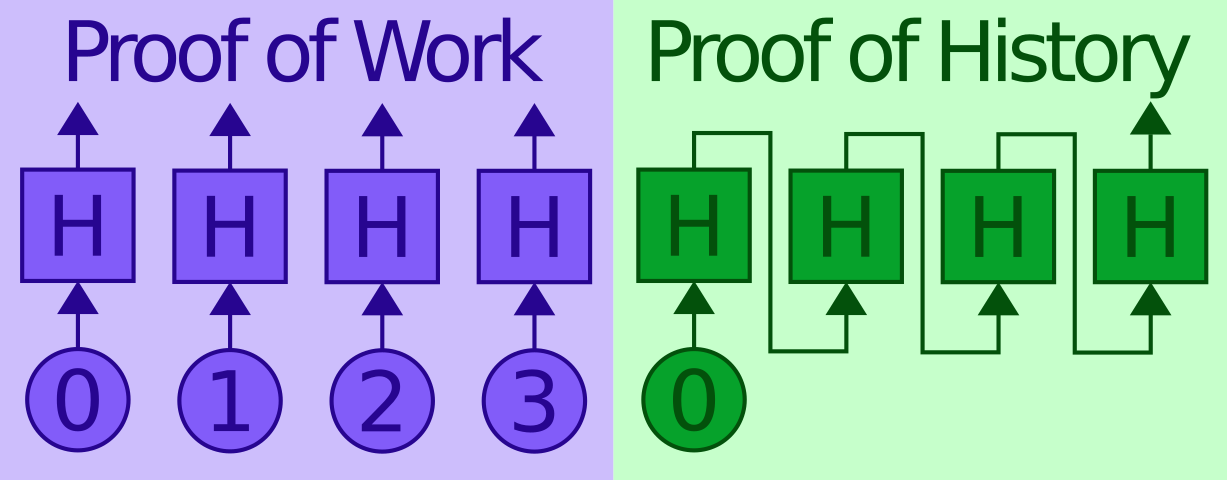

Proof of History (PoH) is a cryptographic clock that creates a verifiable timeline of events, allowing Solana to order transactions before consensus rather than during it.

This is the single most important thing to understand about Solana. Every other blockchain spends enormous resources on one question: what happened first? When thousands of transactions arrive simultaneously, validators need to agree on the order. This coordination takes time. It is the primary reason most blockchains are slow.

Solana flips this process. Proof of History uses a sequential hashing function (SHA 256) that produces a unique output at regular intervals. Each output depends on the previous one. This creates an unbreakable chain of timestamps that proves exactly when each event occurred, without asking any other node to confirm it.

Think of it like a public stopwatch that everyone can read but nobody can manipulate. By the time a transaction reaches the consensus stage, its position in time is already established. Validators do not need to debate ordering. They verify the hash chain and move on.

The result is speed. Solana produces a new block every 400 milliseconds. Compare that to Ethereum's 12 second block time or Bitcoin's 10 minute cycle. The clock never stops.

What Is Solana's Full Consensus Mechanism?

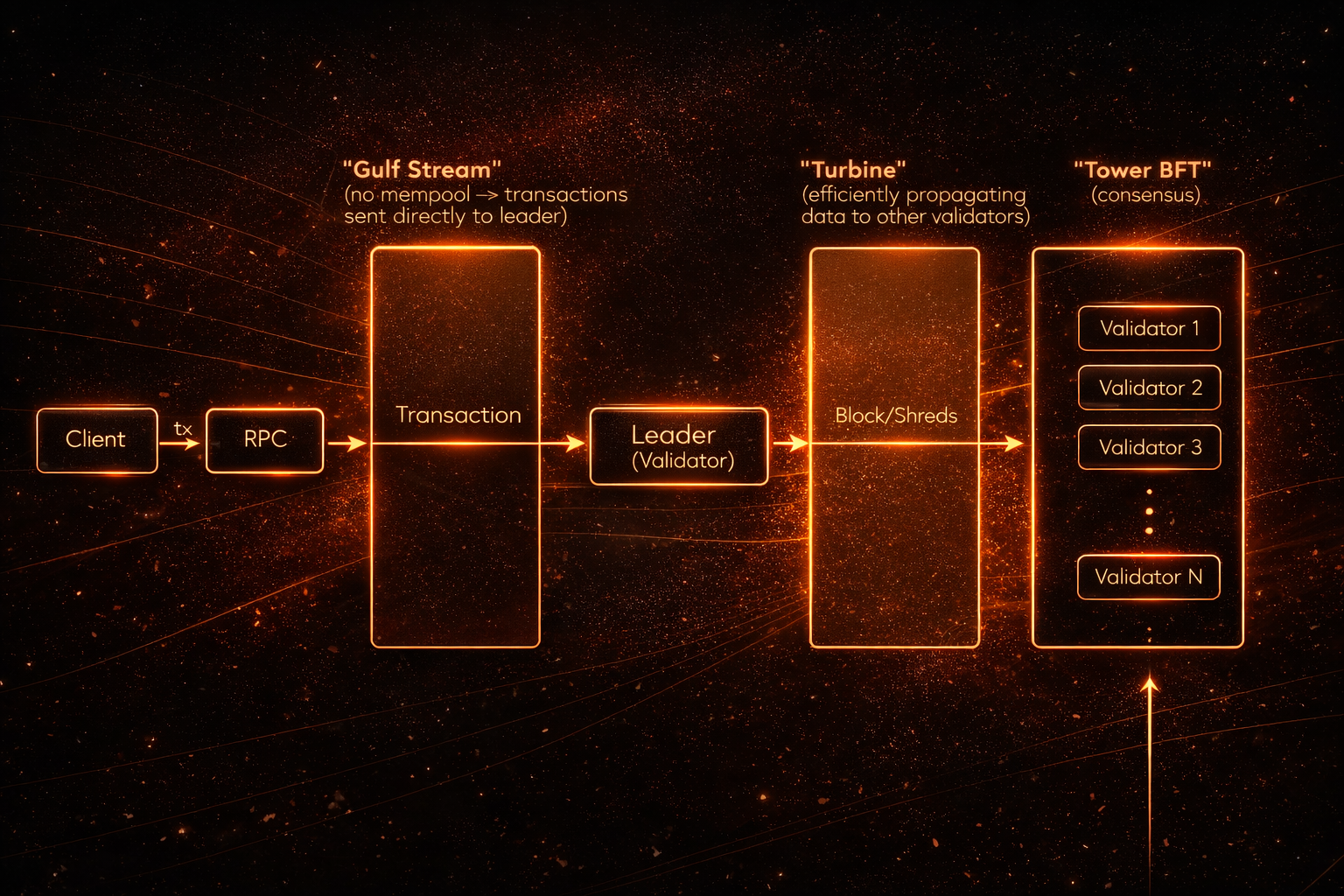

Solana combines Proof of History for transaction ordering with a Proof of Stake (PoS) system called Tower BFT for final consensus and network security.

Proof of History handles timing. Tower BFT handles agreement. When validators confirm a block, they commit a "vote" that becomes more expensive to reverse over time. This creates a practical finality mechanism where older transactions become exponentially harder to undo.

But the innovation does not stop there. Solana runs eight core technologies simultaneously:

Proof of History (PoH). The cryptographic clock that timestamps all events.

Tower BFT. A PoS consensus mechanism optimized for PoH. Validators stake SOL to participate. Malicious behavior risks losing staked tokens.

Sealevel. A parallel transaction processing engine. While most blockchains process smart contracts one at a time, Sealevel runs thousands simultaneously across available GPU cores.

Gulf Stream. A mempool management protocol that pushes transactions to validators before the current block is finalized. This reduces confirmation times and memory pressure.

Turbine. A block propagation protocol inspired by BitTorrent. Instead of sending entire blocks to every node, Turbine breaks data into small packets and distributes them across the network in parallel.

Pipelining. A transaction processing pipeline where different hardware components handle different stages of validation simultaneously. One core verifies signatures while another processes transactions and a third writes to disk.

Cloudbreak. A horizontally scaled state architecture that allows concurrent reads and writes to the blockchain's account database.

Archivers. A distributed storage system for offloading historical data from validators, keeping hardware requirements manageable.

These eight systems work together. PoH creates the timeline. Tower BFT secures agreement. Sealevel parallelizes execution. Gulf Stream eliminates bottlenecks. Turbine speeds propagation. Pipelining optimizes hardware usage. The result is a blockchain that processes thousands of transactions per second at sub penny costs.

What Is the SOL Token Used For?

SOL is Solana's native cryptocurrency, used to pay transaction fees, stake for network security, earn validator rewards, and participate in governance.

Every interaction on Solana requires a small amount of SOL to cover transaction fees. These fees are extraordinarily low. A typical token swap costs a fraction of a cent. Even during peak network activity, fees rarely exceed a few cents.

Here is how the token economy works:

Transaction fees. Every smart contract execution, token transfer, or NFT mint burns a small amount of SOL. Part of each fee is destroyed permanently (similar to Ethereum's EIP 1559 burn mechanism), creating deflationary pressure.

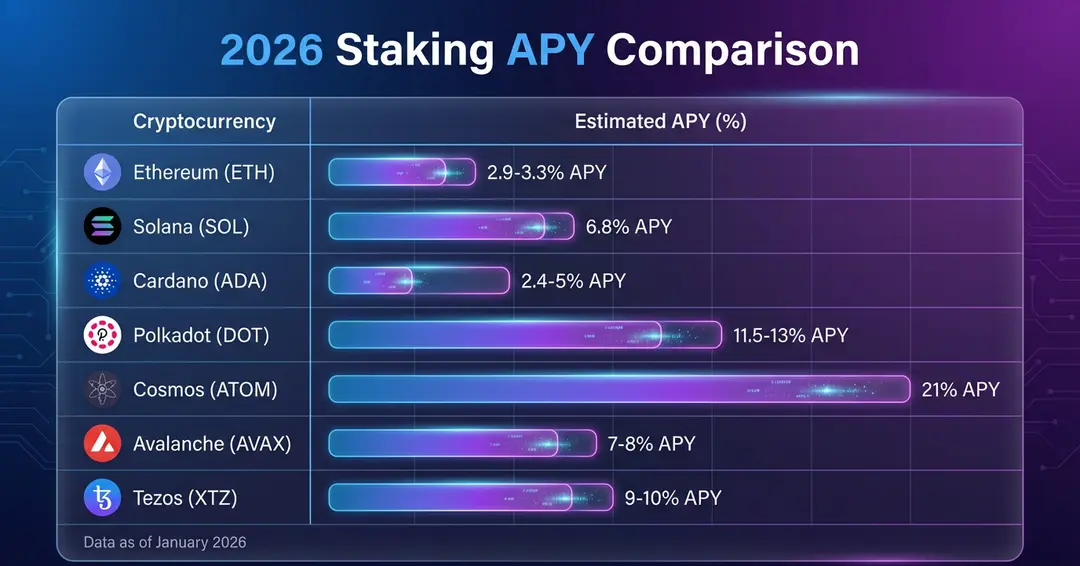

Staking rewards. SOL holders can delegate their tokens to validators who secure the network. Current staking yields range from approximately 5% to 7% annually. This passive income is a major draw for institutional investors, especially compared to Bitcoin's zero yield.

DeFi collateral. SOL serves as the base currency across Solana's decentralized finance ecosystem. It is used as collateral for loans, paired in liquidity pools, and deposited into yield strategies.

Governance. SOL holders can vote on network proposals and protocol upgrades, giving the community direct influence over the blockchain's direction.

As of February 2026, the circulating supply is approximately 568 million SOL with a total supply near 620 million. Solana does not have a hard supply cap like Bitcoin's 21 million. New SOL enters circulation through staking rewards, with the inflation rate decreasing over time through a disinflationary schedule.

What Does the Solana Ecosystem Look Like in 2026?

Solana's 2026 ecosystem spans DeFi, stablecoins, NFTs, real world assets, developer tooling, and institutional finance, supported by 17,700+ active developers and 98 million monthly active users.

The numbers tell the story. Solana processed over 200 billion total transactions. DEX volume exceeded $17 trillion. Protocol revenue reached $2.85 billion. The stablecoin market cap on Solana stands at $14.78 billion. The real world asset (RWA) sector surpassed $1.66 billion in tokenized value.

DeFi Protocols

Jupiter is Solana's leading DEX aggregator, routing trades across multiple liquidity sources to find the best price. It regularly handles billions in daily volume.

Marinade Finance and Jito dominate liquid staking, allowing users to stake SOL while receiving liquid tokens (mSOL, jitoSOL) that can be used across DeFi simultaneously.

Raydium operates as one of the primary automated market makers, providing deep liquidity for token pairs across the ecosystem.

NFTs and Digital Collectibles

Magic Eden and Tensor are the dominant NFT marketplaces on Solana. Low fees make Solana attractive for high volume NFT trading where Ethereum gas costs would eat into margins.

Wallets

Phantom has become one of the most popular crypto wallets globally. It supports Solana, Ethereum, Bitcoin, and Polygon, but its origin and deepest integration remains with the Solana ecosystem.

Infrastructure

Helium migrated its entire decentralized wireless network from its own blockchain to Solana in 2023, validating the network's capacity to handle IoT scale transaction loads.

What Are the Major Solana Upgrades in 2026?

Solana's two biggest upgrades in 2026 are Firedancer (a new validator client targeting 1 million transactions per second) and Alpenglow (a consensus protocol delivering sub 200 millisecond finality).

Firedancer

Firedancer is a completely independent validator client built from scratch by Jump Crypto (now Jump Trading). After three years of development, Firedancer went live on Solana mainnet in late 2025 and has already produced over 50,000 blocks across a growing set of validators.

Why does a second validator client matter? Client diversity is critical for blockchain resilience. If one client has a bug, the network keeps running on the other. Ethereum learned this lesson through multiple client incidents. Solana is now building the same redundancy.

In testing, Firedancer processed over 1 million transactions per second. The architecture isolates each validator task into separate "tiles," making bugs easier to contain and fix. The current state is a hybrid called Frankendancer (combining elements of Firedancer and the original Agave client). The full standalone Firedancer release is expected to complete rollout through 2026.

Alpenglow

Alpenglow is a new consensus protocol designed to replace Solana's current Tower BFT system. The key improvement is finality speed. Current transaction finality on Solana takes several seconds. Alpenglow targets 100 to 150 milliseconds.

For context, that is faster than a human blink. This speed matters for financial applications, high frequency trading, payment systems, and gaming where milliseconds determine user experience.

Together, Firedancer and Alpenglow represent the most significant technical upgrades since Solana launched. If fully deployed, they would give Solana million plus TPS capacity with near instant finality, a combination no other Layer 1 blockchain currently offers.

How Is Institutional Adoption Shaping Solana?

Institutional adoption of Solana accelerated dramatically in 2025 and 2026, with spot ETFs, corporate treasuries, and traditional finance partnerships validating the network.

Spot Solana ETFs

Spot Solana ETFs launched in late 2025 from issuers including Bitwise (BSOL), Fidelity (FSOL), and VanEck. Total Solana ETF assets have surpassed $1 billion. Morgan Stanley filed for its own Solana Trust in early 2026. One key differentiator from Bitcoin ETFs: Solana ETFs can incorporate staking yield, offering investors 5% to 7% annual returns on top of price exposure.

Goldman Sachs

Goldman Sachs disclosed over $260 million in combined Solana and XRP ETF holdings as of early 2026, with more than $108 million allocated specifically to Solana products. This makes Goldman one of the largest institutional holders of Solana ETFs.

Forward Industries

Forward Industries (NASDAQ: FORD) transformed into a Solana focused treasury company, holding over 6.9 million SOL (valued near $1 billion at peak). The firm launched a $1 billion share repurchase program and operates its own validator node on the network.

Western Union

Western Union announced plans to launch USDPT, a stablecoin built on Solana, in the first half of 2026. The 174 year old payments giant processes roughly $150 billion in annual remittance volume. If even a fraction migrates to Solana, it would represent a massive increase in network stablecoin activity.

Real World Asset Tokenization

Galaxy Digital partnered with Superstate in September 2025 to tokenize its SEC registered Class A Common Stock directly on the Solana blockchain. This was one of the first examples of a public company tokenizing regulated equity on a decentralized network.

How Does Solana Compare to Ethereum?

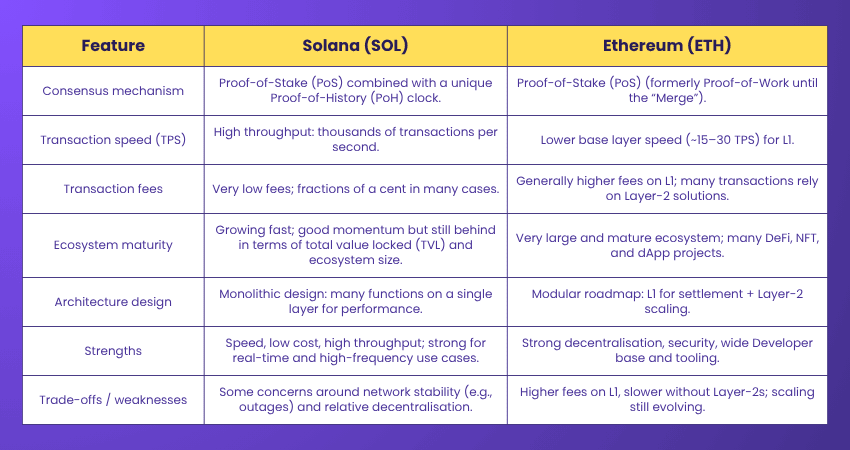

Solana is faster and cheaper than Ethereum at the base layer, but Ethereum has a larger ecosystem, deeper liquidity, and a more established decentralization track record.

Here is the comparison that matters:

Speed. Solana processes 2,000 to 4,000 transactions per second in production (targeting 1M+ with Firedancer). Ethereum processes 15 to 30 at the base layer, though Layer 2 networks like Arbitrum, Optimism, and Base extend this significantly.

Fees. Solana fees cost fractions of a penny. Ethereum base layer fees regularly cost dollars. Layer 2 fees are cheaper (often pennies) but still higher than Solana.

Architecture. Solana is a single layer, monolithic blockchain. Everything runs on one chain. Ethereum adopted a modular approach with separate Layer 2 networks handling execution while the base layer provides security. Solana avoids the liquidity fragmentation that comes with multiple Layer 2 networks.

DeFi TVL. Ethereum and its Layer 2 networks hold approximately $110 billion in combined DeFi value. Solana holds roughly $8 to $10 billion. Ethereum's lead is significant but narrowing.

Developer language. Ethereum uses Solidity. Solana uses Rust. Solidity has a larger developer base. Rust is considered more performant and secure but has a steeper learning curve.

Decentralization. Ethereum has roughly 1 million validators. Solana has approximately 1,500 to 2,000 validators with higher hardware requirements. Ethereum is more decentralized at the validator level. Solana argues that its single layer approach avoids centralization at the rollup and sequencer level that affects Ethereum's Layer 2 networks.

Neither blockchain is "better" in absolute terms. Solana optimizes for speed and cost. Ethereum optimizes for decentralization and ecosystem depth. Many serious crypto users hold both.

What Are the Biggest Risks of Investing in Solana?

Solana's primary risks include network outage history, validator centralization, tokenomics criticism, Ethereum Layer 2 competition, and regulatory uncertainty.

Outage History

Solana suffered several extended outages in 2021 and 2022. Spam transactions overwhelmed the network, causing validators to fall out of sync. These downtime events damaged credibility and raised questions about reliability. Since then, Solana has achieved 99.9%+ uptime through engineering improvements, fee market upgrades, and the introduction of priority fees. But the history is part of the record.

Centralization Concerns

Running a Solana validator requires powerful hardware compared to Ethereum. This raises the barrier to entry and concentrates validation power among fewer, well funded operators. The Solana Foundation has worked to expand geographic distribution and reduce dependence on any single data center provider, but this remains an active area of criticism.

Token Supply Pressure

Unlike Bitcoin's fixed 21 million supply, Solana has an inflationary token model. New SOL enters circulation through staking rewards. Early VC investors received significant allocations at low prices, and periodic token unlocks have created selling pressure. The inflation rate decreases over time through a disinflationary schedule, but concerns about dilution persist.

Competition from Ethereum Layer 2s

Arbitrum, Optimism, Base, and zkSync offer fast, cheap transactions while inheriting Ethereum's security guarantees. As Layer 2 ecosystems mature, they compete directly with Solana's value proposition. The counterargument is that Solana's single layer simplicity avoids the fragmented liquidity and user experience challenges of navigating multiple Layer 2 networks.

Regulatory Uncertainty

The SEC has previously listed SOL among tokens it considers potential securities. While the regulatory environment has shifted with spot ETF approvals and the proposed CLARITY Act, legal classification remains unresolved. Any adverse ruling could impact SOL's availability on US exchanges.

FTX Legacy

The FTX collapse in November 2022 hit Solana particularly hard. FTX founder Sam Bankman Fried was a major Solana supporter. Alameda Research held large SOL positions. The crash tanked SOL from over $30 to under $10. While the ecosystem recovered dramatically, the association lingers in public memory.

How Does Solana Staking Work?

Solana staking lets SOL holders delegate their tokens to validators who secure the network, earning approximately 5% to 7% annual rewards without giving up token ownership.

The process is straightforward:

Step 1. Choose a validator. You can browse active validators through tools like Solana Beach or StakeWiz. Look at commission rates, uptime history, and total stake.

Step 2. Delegate your SOL through a wallet like Phantom. Your tokens remain in your wallet. You are not transferring ownership to the validator. You are assigning your stake weight.

Step 3. Earn rewards. Each epoch (roughly two days), rewards are calculated and distributed based on validator performance. Typical yields run 5% to 7% annually.

Step 4. Unstake when you want. There is an unstaking period of approximately one epoch before your SOL becomes liquid again.

Liquid staking offers an alternative. Protocols like Marinade Finance and Jito let you stake SOL and receive a liquid token (mSOL or jitoSOL) in return. This token represents your staked position and can be used in DeFi simultaneously. You earn staking rewards while your capital stays productive.

The staking yield is a competitive advantage. Bitcoin offers zero native yield. Ethereum offers roughly 3% to 4%. Solana's 5% to 7% makes it attractive for income oriented investors and gives Solana ETFs a built in return advantage over Bitcoin ETFs.

How to Buy SOL in 2026

The quickest, most flexible, and user-friendly way to buy SOL is through the Bitunix exchange. Bitunix allows you to trade quickly without getting stuck in complex identity verification (KYC) processes. Alternatively, you can use wallets like Phantom or traditional ETFs as secondary options.

Here is the quickest path:

1. On Bitunix Exchange (Recommended)

Bitunix is the most practical platform for buying SOL for both spot and futures trading.

Bitunix - a leading crypto derivatives exchange that makes your trading easy. Buy, sell, trade BTC & altcoins, and get easy access to the futures market.

- Create an Account: Go to Bitunix and sign up in seconds using just your email address (offers a quick start with optional KYC).

- Deposit Funds: Use the "Buy Crypto" tab to deposit USDT or fiat currency directly using your credit/debit card, or via integrated payment providers like MoonPay and Banxa.

- Buy SOL: Search for the SOL/USDT pair in the spot market and place a "Buy" order. SOL will be instantly credited to your wallet. From here, you can withdraw assets to a personal wallet or use them for futures trading on Bitunix.

2. Through Personal Wallets

If you prefer to take self-custody of the SOL you bought on Bitunix, the Phantom wallet is ideal.

- You can transfer the SOL from your Bitunix account to your Phantom wallet address via a "Withdraw" transaction.

- Alternatively, Phantom offers direct purchases using integrated payment providers, though this often comes with higher fees compared to buying on an exchange like Bitunix.

3. Through ETFs

If you prefer a traditional brokerage account, Spot Solana ETFs from Bitwise (BSOL), Fidelity (FSOL), and VanEck are available. These trade on regulated exchanges alongside stocks and require no crypto wallet, but they do not offer the 24/7 trading flexibility of Bitunix.

Security Tip

For significant amounts, a hardware wallet like Ledger provides the highest security. Transfer your SOL from Bitunix to your Ledger address and stake directly through Phantom or SolFlare connected to the hardware device.

The Bottom Line

Solana is a blockchain built for speed. Its Proof of History innovation solved a problem that limits every other network: coordinating time across thousands of nodes. The result is a chain that processes thousands of transactions per second at costs measured in fractions of a penny.

The 2026 ecosystem is no longer experimental. It has 17,700+ active developers, 98 million monthly users, $14.78 billion in stablecoins, spot ETFs with over $1 billion in assets, Goldman Sachs and Morgan Stanley exposure, and a 174 year old payments company building on its rails.

Is it risk free? Not even close. Outage history haunts it. Centralization questions persist. Competition from Ethereum's Layer 2 networks is real. Token supply pressure is a valid concern. And regulatory clarity is still forming.

But Solana is no longer fighting for survival. It is fighting for dominance. With Firedancer targeting a million transactions per second and Alpenglow promising finality faster than a blink, the technical roadmap is the most ambitious in crypto.

Whether you are here to understand the technology or evaluate an investment, one thing is clear. Solana is not trying to be a faster Ethereum. It is building something structurally different. And the institutions are paying attention.

This article is for educational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry significant risk. Always conduct your own research before buying any digital asset.