What Is DeFi? Everything You Need to Know About Decentralized Finance in 2026

From zero to fluent in decentralized finance — no jargon required.

You have heard the word. You have seen the headlines. But when someone asks you to explain DeFi, you go blank.

That is the problem. DeFi is actively reshaping global finance, and in 2026 it is no longer a fringe experiment. It is powering institutional products, government bond settlements, and everyday payments across dozens of countries. Yet most explanations remain buried in blockchain jargon that serves no one.

This guide strips all that away.

By the end, you will know exactly what DeFi is, how it works, where the real risks live, and whether it belongs in your financial life today.

Key Takeaways

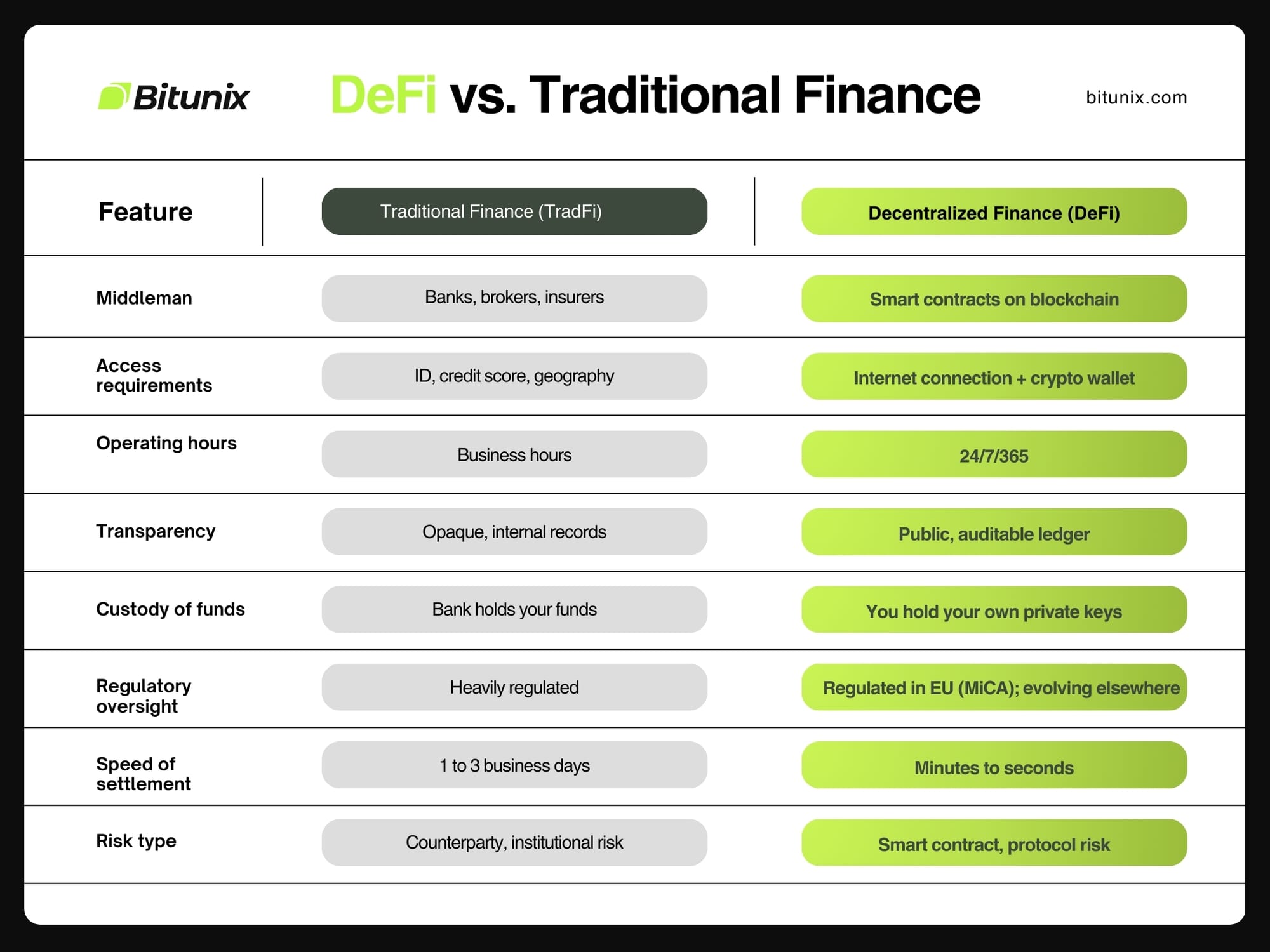

- DeFi stands for decentralized finance — financial services that run on public blockchains with no banks, brokers, or intermediaries.

- Smart contracts replace middlemen, executing transactions automatically when preset conditions are met.

- According to DeFi Llama's February 2026 data, total value locked (TVL) across DeFi protocols has surpassed $180 billion, a new all-time high that eclipses the 2021 peak.

- DeFi carries real risks: smart contract exploits, regulatory complexity, and extreme asset volatility. Understanding these is not optional.

What Is DeFi and How Does It Work? The Answer in Plain English

DeFi is a system of financial applications built on public blockchains that operate without banks, brokers, or any central authority.

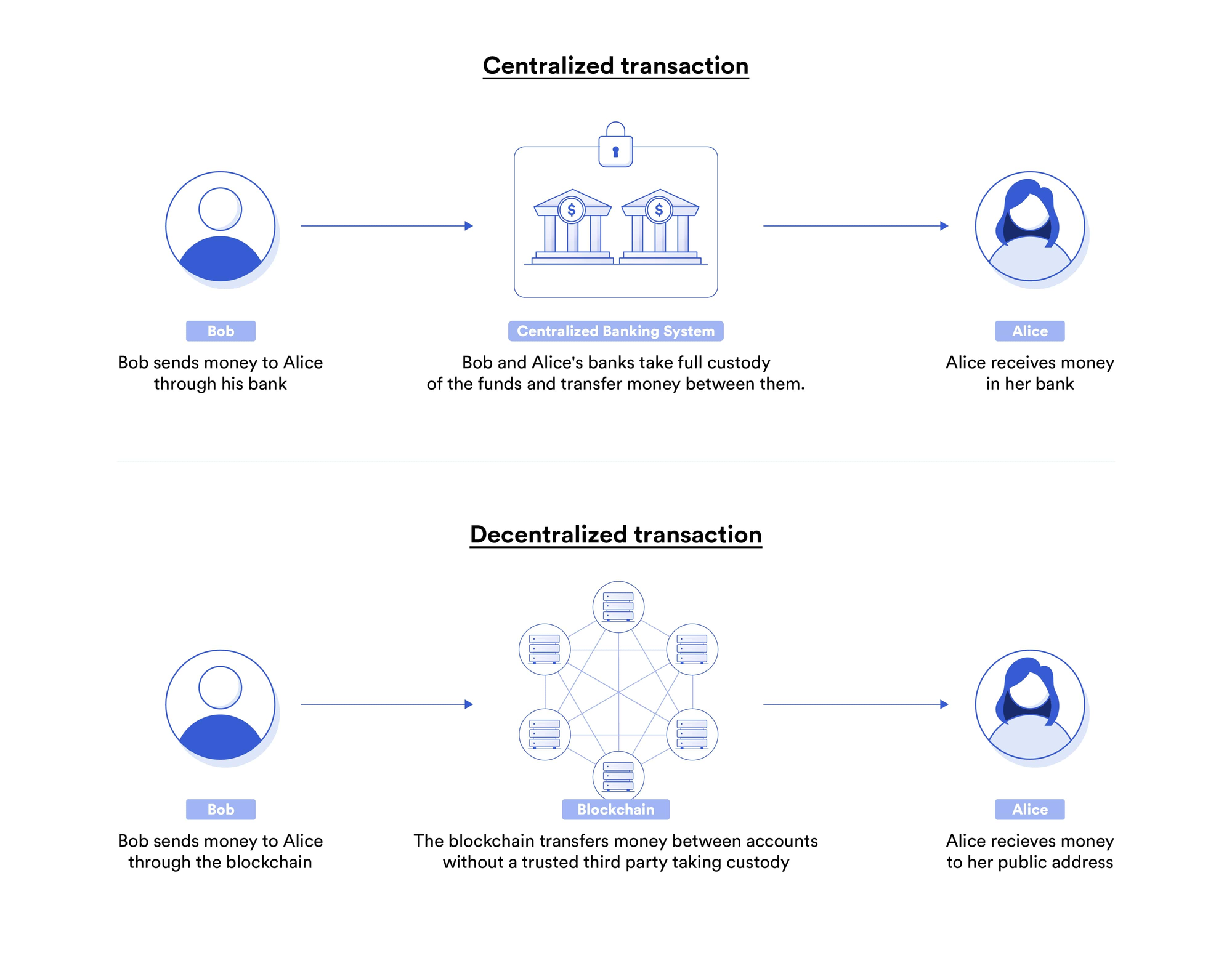

Traditional finance requires a middleman for almost everything. You want a loan — you go to a bank. You want to trade a stock — you go through a broker. Every one of those middlemen charges fees, sets the rules, and can cut you off.

DeFi removes them entirely.

Instead of a bank processing your loan application, a smart contract does it. A smart contract is self-executing code stored on a blockchain. It follows rules coded into it at deployment and runs automatically. No human approval is needed, no business hours apply, and no geography restrictions exist.

How Smart Contracts Power DeFi

Smart contracts are the engine under DeFi's hood. They are programs that live on blockchains like Ethereum and execute automatically whenever specific conditions are triggered.

Think of a vending machine. You insert the right amount, press the button, and the machine gives you the item. No cashier needed. Smart contracts work the same way. They are programmable vending machines for financial services.

The Ethereum Foundation pioneered smart contract infrastructure and its network remains the dominant base layer for DeFi applications in 2026. Competing smart contract platforms like Solana, Avalanche, and Base have grown significantly, but Ethereum still settles the majority of DeFi volume.

What Happens on the Blockchain?

Every DeFi transaction is recorded on a public, immutable ledger. Anyone can verify it. No single entity controls it. This is what "decentralized" means in practice.

When you interact with a DeFi protocol, your wallet signs the transaction. The blockchain confirms it. The smart contract executes. Done. No human touched that process at any point.

DeFi vs. Traditional Finance: A Side-by-Side Look

Is DeFi Safe to Use in 2026? What Every User Must Understand First

DeFi is not inherently safe — it is inherently transparent, and that distinction changes everything.

Transparency means you can audit the code. It does not mean the code is bug-free. It does not mean prices will not crash. It does not mean you cannot make a costly, irreversible mistake.

According to Chainalysis's 2025 Crypto Crime Report, cumulative losses from DeFi exploits between 2020 and 2024 exceeded $7 billion. The good news: the frequency of major hacks declined year-over-year in 2024 and 2025 as auditing standards improved. The bad news: the attacks that do succeed are growing in sophistication.

Smart Contract Risk

Every DeFi protocol is only as safe as its code. A flaw in a smart contract can be exploited to drain an entire liquidity pool in seconds. Unlike a traditional bank where FDIC insurance protects deposits up to $250,000, DeFi has no government-backed safety net.

Reputable protocols commission multiple third-party audits from firms like Certik, Trail of Bits, and OpenZeppelin before launching. In 2025, community-funded bug bounty programs became the norm for major protocols. But even multiply-audited contracts have been exploited. Audits reduce risk; they do not eliminate it.

Custody Risk and the Private Key Reality

In DeFi, you are your own bank. You control your private keys — the cryptographic password to your wallet. Lose those keys and your funds are permanently inaccessible. No customer support line exists. No recovery process is available.

This is a feature from the protocol's design perspective. For users accustomed to password resets and bank call centers, it represents a serious and non-negotiable adjustment.

Market Volatility and Liquidation Risk

DeFi lending protocols like Aave and Sky Protocol (formerly MakerDAO) use collateralized loans. You deposit crypto as collateral and borrow against it. If the collateral's value drops below a defined threshold, the protocol automatically liquidates your position to protect lenders.

In fast market crashes, liquidations cascade across protocols simultaneously. This has wiped out thousands of overleveraged positions during every major market downturn since 2020. The math is unforgiving and fully automated.

What Are the Best DeFi Platforms in 2026? A Practical Breakdown

The best DeFi platforms depend entirely on what you want to do — trade, lend, borrow, or earn yield.

The category you choose determines your risk profile, your gas costs, and your learning curve. Here are the dominant protocols in each segment as of early 2026.

Decentralized Exchanges (DEXs)

A DEX lets you trade crypto assets directly from your wallet, peer-to-peer, with no company holding your funds at any point.

Uniswap remains the most widely used DEX globally. It runs on Ethereum and multiple Layer 2 networks using an automated market maker (AMM) model. Instead of matching buyers to sellers through an order book, it uses liquidity pools funded by users who earn trading fees in return. By Q4 2025, Uniswap's cumulative trading volume had surpassed $2.5 trillion since its 2018 launch, according to its on-chain analytics dashboard.

Curve Finance dominates stablecoin and real-world asset swaps due to its low-slippage design. As RWA tokenization expanded through 2025, Curve's volume in tokenized asset pairs grew substantially.

Jupiter on Solana emerged as the leading DEX aggregator on that chain, routing trades across multiple liquidity sources to find the best price automatically.

DeFi Lending and Borrowing

Aave and Sky Protocol (MakerDAO's rebranded successor) remain the two pillars of DeFi lending.

Aave expanded to eight blockchain networks by early 2026 and introduced its GHO stablecoin into broader use cases including payroll and cross-border settlement pilots. Interest rates are set algorithmically based on real-time supply and demand.

Sky Protocol governs DAI and USDS, its decentralized stablecoins soft-pegged to the U.S. dollar. The protocol holds over $10 billion in collateral including both on-chain crypto and tokenized U.S. Treasury assets, making it a live example of hybrid on-chain collateral management at scale.

Yield Aggregators and Real-World Asset Protocols

Protocols like Yearn Finance automatically move user deposits across lending markets to maximize yield. They function as algorithmic robo-advisors for DeFi liquidity.

A new category that matured significantly in 2025 is RWA (real-world asset) yield protocols. Platforms like Ondo Finance and Maple Finance now offer on-chain access to tokenized U.S. Treasuries and private credit, providing DeFi yields backed by off-chain financial instruments. This category attracted over $15 billion in TVL by the end of 2025, according to RWA.xyz's annual market report.

How Do You Make Money With DeFi? The Real Mechanics

The three primary ways to earn in DeFi are liquidity provision, lending, and yield farming — and none of them are truly passive.

Each strategy carries distinct risk profiles that must be understood before any capital is committed.

Liquidity Provision

When you deposit token pairs into a DEX liquidity pool like Uniswap's, you earn a share of every trading fee generated from that pool. Fee tiers vary from 0.01% for stablecoin pairs to 1% for exotic asset pairs, with corresponding risk differences.

The primary trade-off is impermanent loss. This occurs when the price ratio of your deposited tokens changes after deposit, leaving you with less value than if you had simply held the tokens. In volatile markets, impermanent loss can erase fee earnings entirely. Understanding this mechanic is mandatory before providing liquidity.

Lending

On Aave or Sky Protocol, you deposit assets into a lending pool and earn variable interest paid by borrowers. Rates fluctuate continuously based on utilization. In markets with high borrowing demand for specific assets, APYs can spike significantly for short periods before normalizing.

Stablecoin lending tends to offer steadier, more predictable yields than volatile crypto asset lending. This makes it the preferred entry point for risk-conscious DeFi participants in 2026.

Yield Farming

Yield farming involves moving capital between protocols strategically to capture governance token rewards alongside base interest rates. At its peak in 2020's "DeFi Summer," some protocols offered triple-digit APYs to attract liquidity.

Those rates collapsed rapidly. Today, sustainable DeFi yields on established protocols range from 3% to 15% annually for stablecoin strategies, with higher yields still available for riskier positions. Yield farming now requires active management, regular rebalancing, and a solid grasp of each protocol's tokenomics and long-term viability.

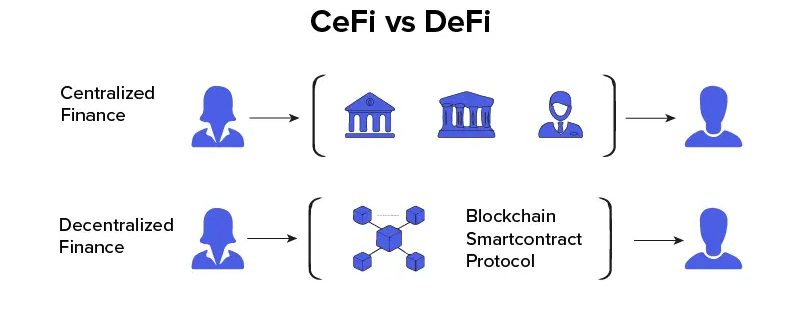

What Is the Difference Between DeFi and CeFi? Choosing Your Path

CeFi (centralized finance) refers to crypto platforms that operate like traditional financial institutions — a company holds your assets and controls your transactions.

Exchanges like Coinbase or Kraken are CeFi. They are crypto-native but centralized. You create an account, verify your identity through KYC, deposit funds, and trust the company to manage them responsibly.

DeFi removes that trust requirement entirely. You interact directly with code.

Where CeFi Wins?

CeFi offers user-friendly interfaces, customer support, fiat on-ramps, and regulatory compliance that institutions require. For beginners, users moving large capital amounts, or anyone operating under a compliance framework, these advantages are real and significant.

Where DeFi Wins?

DeFi provides self-custody, permissionless global access, greater yield potential, and exposure to financial primitives unavailable in CeFi environments. For technically literate users who understand and accept the risks, DeFi offers a level of financial autonomy that no bank can match.

The FTX Lesson Is Still Relevant in 2026

The 2022 collapse of FTX, at the time one of the world's largest crypto exchanges, demonstrated what happens when users trust a centralized party with custody of their assets. Approximately $8 billion in customer funds were lost. The subsequent criminal conviction of its founder reinforced that CeFi risk is fundamentally counterparty risk — you are trusting the people running the company.

True DeFi protocols cannot misappropriate user funds in the same way. The code holds the assets and executes rules transparently. This remains one of DeFi's most compelling structural arguments to new users in 2026.

The Regulatory Picture in 2026: What Governments Have Decided

The global regulatory environment for DeFi shifted decisively in 2025 and continues evolving rapidly into 2026.

The era of regulatory ambiguity is largely over for centralized crypto entities. For pure DeFi protocols, the picture is more complex.

The European Union's Markets in Crypto-Assets Regulation (MiCA) reached full enforcement in 2025, establishing the world's first comprehensive regulatory framework for crypto assets. MiCA covers stablecoin issuers, crypto asset service providers, and exchanges with clear capital requirements, disclosure mandates, and consumer protection rules. Most centralized crypto businesses serving EU customers are now operating under MiCA licenses or have exited the market.

True DeFi protocols — where no identifiable legal entity controls the smart contracts or holds user assets — remain in a regulatory gray zone under MiCA. The European Securities and Markets Authority (ESMA) published guidance in late 2025 indicating that governance token holders of DeFi protocols may bear regulatory responsibilities in certain circumstances. That guidance is being actively contested by the industry.

In the United States, the U.S. Securities and Exchange Commission (SEC) reached several landmark settlements with hybrid DeFi-CeFi platforms in 2024 and 2025. Congress passed the Digital Asset Market Structure Act in late 2025, providing clearer jurisdictional boundaries between the SEC and the Commodity Futures Trading Commission (CFTC) for crypto assets. Full implementation rules are expected throughout 2026.

Regulatory clarity, wherever it lands, is generally viewed as a prerequisite for large-scale institutional capital entering DeFi.

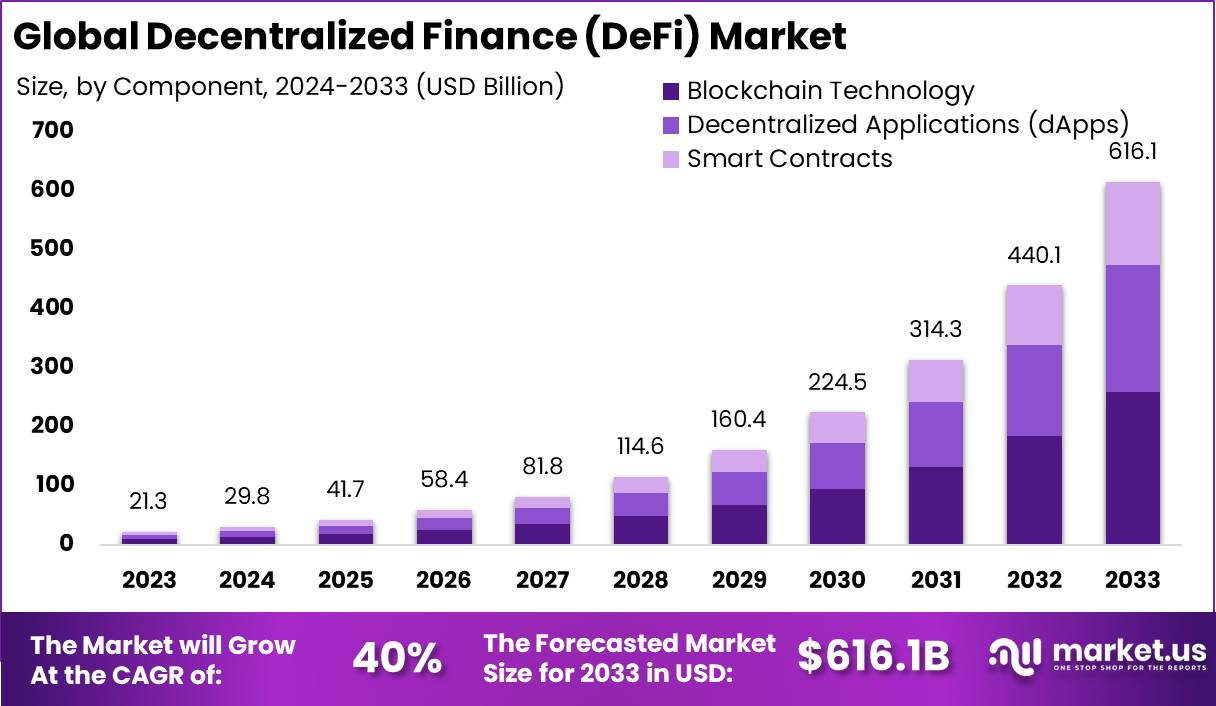

What Does the Future Hold? DeFi's Trajectory Through 2028

DeFi is completing its transition from speculative infrastructure into a parallel financial system with real institutional participation.

Three trends define where the next two to three years are heading.

Real-World Asset Tokenization Is Now the Dominant Growth Driver

Tokenizing real-world assets — government bonds, real estate, private credit, commodities — and settling them on-chain is no longer experimental. It is happening at scale.

BlackRock's tokenized U.S. Treasury fund (BUIDL), launched on Ethereum in 2024, exceeded $1 billion in assets under management within six months. By Q3 2025, over a dozen asset managers had followed with their own on-chain fund products. According to a 2025 report by the Boston Consulting Group, the tokenized asset market could reach $16 trillion by 2030, representing one of the largest capital migrations in financial history.

DeFi provides the settlement rails, liquidity pools, and composability that make this migration viable. The distinction between "DeFi" and "traditional finance" is blurring at the institutional level faster than most observers predicted.

Layer 2 Networks Have Solved the Cost Problem

The high transaction fees that historically made Ethereum unusable for small transactions are functionally solved in 2026. Layer 2 networks — Arbitrum, Optimism, Base, and zkSync — now process the majority of Ethereum ecosystem transactions at costs measured in fractions of a cent.

This cost reduction has enabled an entirely new category of DeFi users: everyday users in emerging markets who can access dollar-denominated savings, cross-border remittances, and micro-loans without a bank account. According to a 2025 World Bank report on financial inclusion, blockchain-based financial services saw their fastest adoption growth in Southeast Asia, Sub-Saharan Africa, and Latin America, regions where traditional banking infrastructure remains underdeveloped.

Decentralized Identity Will Define the Next Era

The remaining friction between DeFi's permissionless architecture and institutional compliance requirements is identity. Institutions cannot participate in lending markets without KYC verification. But building identity verification into DeFi risks recreating the exclusionary gatekeeping of traditional finance.

Zero-knowledge proof based identity systems — where users cryptographically prove they are verified without revealing personal data — are moving from research into production in 2026. Protocols built on this infrastructure could satisfy regulatory requirements while preserving the privacy and openness that define DeFi's core value proposition. This is the technical frontier that will determine how much institutional capital eventually flows into DeFi systems.

Related Articles / Cluster Topics

The following topics form the semantic cluster that supports this pillar page. Each one answers a more specific question a DeFi reader is likely to search next.

- How Do Smart Contracts Work? — This page deepens the technical foundation of DeFi, helping readers understand the code layer that makes all DeFi functionality possible. Without grasping smart contracts, understanding DeFi protocols is superficial. Search Intent: Informational.

- Best DeFi Wallets for Beginners in 2026 — Readers who understand DeFi conceptually immediately need a wallet to interact with any protocol. This cluster page converts understanding into action and meets high commercial intent. Search Intent: Commercial.

- What Is Yield Farming and Is It Worth It? — A direct extension of the earning section above, targeting users ready to move from learning to doing. This page handles the tactical complexity that the pillar page introduces but cannot fully resolve. Search Intent: Informational/Commercial.

- DeFi vs. CeFi: Which Is Right for You in 2026? — This comparison topic captures users in the decision stage who have already committed to crypto finance but are still choosing their model. It channels high-intent traffic toward actionable conclusions. Search Intent: Commercial.

- How DeFi Is Regulated: MiCA, SEC, and Global Rules in 2026 — As regulatory frameworks now actively shape what DeFi products are available in which jurisdictions, this topic attracts a separate high-intent audience of investors, compliance teams, and legal professionals. Search Intent: Informational.

Start Here: Your First Move Into DeFi in 2026

DeFi is not a trend to watch from a distance anymore. It is infrastructure — the same way the internet once was.

Whether it belongs in your financial life right now depends on your risk tolerance, your technical readiness, and your goals. But understanding it is no longer optional for anyone serious about the next decade of finance.

Your move: Go to ethereum.org and spend 20 minutes on their plain-English introduction to Web3 and decentralized applications. It is the most accurate, non-promotional foundation available anywhere online. Then create a MetaMask wallet — without funding it — and explore the interface. You will learn more in 30 minutes of hands-on exploration than in hours of reading.

Quick Win for Beginners

First step today: Create a free MetaMask wallet at metamask.io — do not fund it yet. Navigate to app.uniswap.org and connect your empty wallet. Explore the interface, read the token pair descriptions, and observe how a decentralized exchange presents itself to users. No money moves until you choose it.

Resource: The Ethereum Foundation's learning hub at ethereum.org/en/learn offers free, regularly updated educational content written and reviewed by protocol developers — not marketers.

Question to sit with: If every financial intermediary you currently rely on disappeared tomorrow, what would you need to understand that you currently delegate to others without thinking?

⚠️ YMYL Disclaimer: This article is for educational purposes only and does not constitute financial, investment, or legal advice. DeFi protocols carry significant risks including total and permanent loss of capital. Regulatory status of DeFi products varies by jurisdiction, is actively evolving in 2026, and may affect what products or strategies are legally accessible to you. Before committing any funds to DeFi platforms or strategies, consult a certified financial advisor and a legal professional with current knowledge of crypto asset regulation in your specific country.