What Is Cryptocurrency? Everything You Need to Know in 2026

Cryptocurrency is a form of digital money that uses cryptography for security and operates on decentralized networks without the need for banks or governments. Since Bitcoin launched in 2009, thousands of cryptocurrencies have been created, building an ecosystem now worth over $2 trillion at its peaks.

But what exactly makes cryptocurrency different from the money in your bank account? And why do millions of people around the world own, trade, and build with it? This guide covers the fundamentals.

How Cryptocurrency Works?

Traditional money flows through centralized systems. When you pay for coffee with your debit card, your bank verifies the transaction, deducts the funds, and sends them to the merchant's bank. Multiple intermediaries take a cut, and the process depends entirely on trust in those institutions.

Cryptocurrency removes those intermediaries. Instead of a bank ledger that one company controls, crypto transactions are recorded on a blockchain, which is a distributed database maintained by thousands of independent computers worldwide. No single entity owns it. No single entity can alter it.

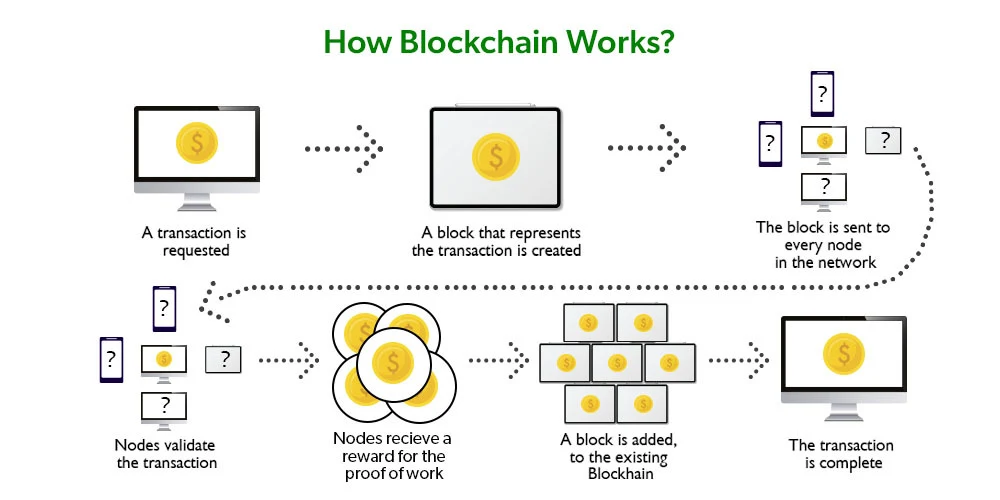

When you send cryptocurrency to someone, the transaction gets broadcast to the network. Validators (depending on the network, these are either miners or stakers) confirm the transaction is legitimate, meaning you actually own the funds and have not already spent them. Once confirmed, the transaction is permanently written to the blockchain. It cannot be reversed, edited, or deleted.

This entire process happens without anyone needing to know your name, without any bank approving the transfer, and usually within seconds to minutes.

Blockchain: The Foundation

A blockchain is a chain of data blocks, each containing a batch of transactions. Every block references the one before it through a cryptographic hash, creating a tamper proof timeline. If someone tried to alter a transaction in block 500, it would change the hash of that block, which would break the chain from block 501 onward. The entire network would immediately reject the fraudulent version.

This design makes blockchains extremely secure. Bitcoin's blockchain, for example, has never been hacked in its sixteen year history. The security comes not from a firewall or a password, but from the mathematical impossibility of rewriting history across thousands of machines simultaneously.

Types of Cryptocurrency

Not all cryptocurrencies serve the same purpose. The ecosystem has evolved into distinct categories:

Layer 1 Blockchains are the foundational networks that process and record transactions. Bitcoin (BTC) is the original, designed primarily as a store of value and peer to peer payment system. Ethereum (ETH) expanded the concept by adding smart contracts, programmable code that executes automatically when conditions are met. Other Layer 1s include Solana (SOL), which prioritizes speed, and Cardano (ADA), which emphasizes academic rigor in its development.

Stablecoins are cryptocurrencies pegged to a stable asset, usually the U.S. dollar. Tether (USDT) and USD Coin (USDC) are the most widely used. They maintain a 1:1 value with the dollar, making them useful for trading, payments, and as a safe harbor during volatile periods. Stablecoins have become the backbone of crypto trading, processing hundreds of billions in daily volume.

Utility Tokens power specific platforms or applications. Chainlink (LINK) provides data feeds to smart contracts. Uniswap (UNI) governs a decentralized exchange. Filecoin (FIL) incentivizes decentralized file storage. These tokens derive their value from the demand for the service they enable.

Memecoins started as jokes but became a significant market force. Dogecoin (DOGE) began as a parody of Bitcoin in 2013. Shiba Inu (SHIB) followed a similar path. While some traders have made fortunes on memecoins, they carry extreme risk and are driven almost entirely by social media sentiment and speculation.

DeFi Tokens represent the decentralized finance movement, which aims to rebuild traditional financial services like lending, borrowing, and trading without banks. Protocols like Aave, Compound, and MakerDAO allow users to earn interest, take loans, and trade assets directly from their wallets.Market cap means the total value of a coin or token.

Here are the biggest ones:

| Rank | Cryptocurrency | Main Use |

|---|---|---|

| 1 | Bitcoin (BTC) | Digital store of value, payments |

| 2 | Ethereum (ETH) | Smart contracts, DeFi, NFTs |

| 3 | Tether (USDT) | Stablecoin for trading and transfers |

| 4 | BNB | Exchange token for Binance ecosystem |

| 5 | Solana (SOL) | High-speed blockchain for apps & games |

| 6 | XRP | Cross-border payments |

| 7 | USD Coin (USDC) | Transparent USD-backed stablecoin |

| 8 | Cardano (ADA) | Research-based smart contract platform |

| 9 | Dogecoin (DOGE) | Small payments, tipping |

| 10 | TRON (TRX) | Decentralized content sharing |

Proof of Work vs. Proof of Stake

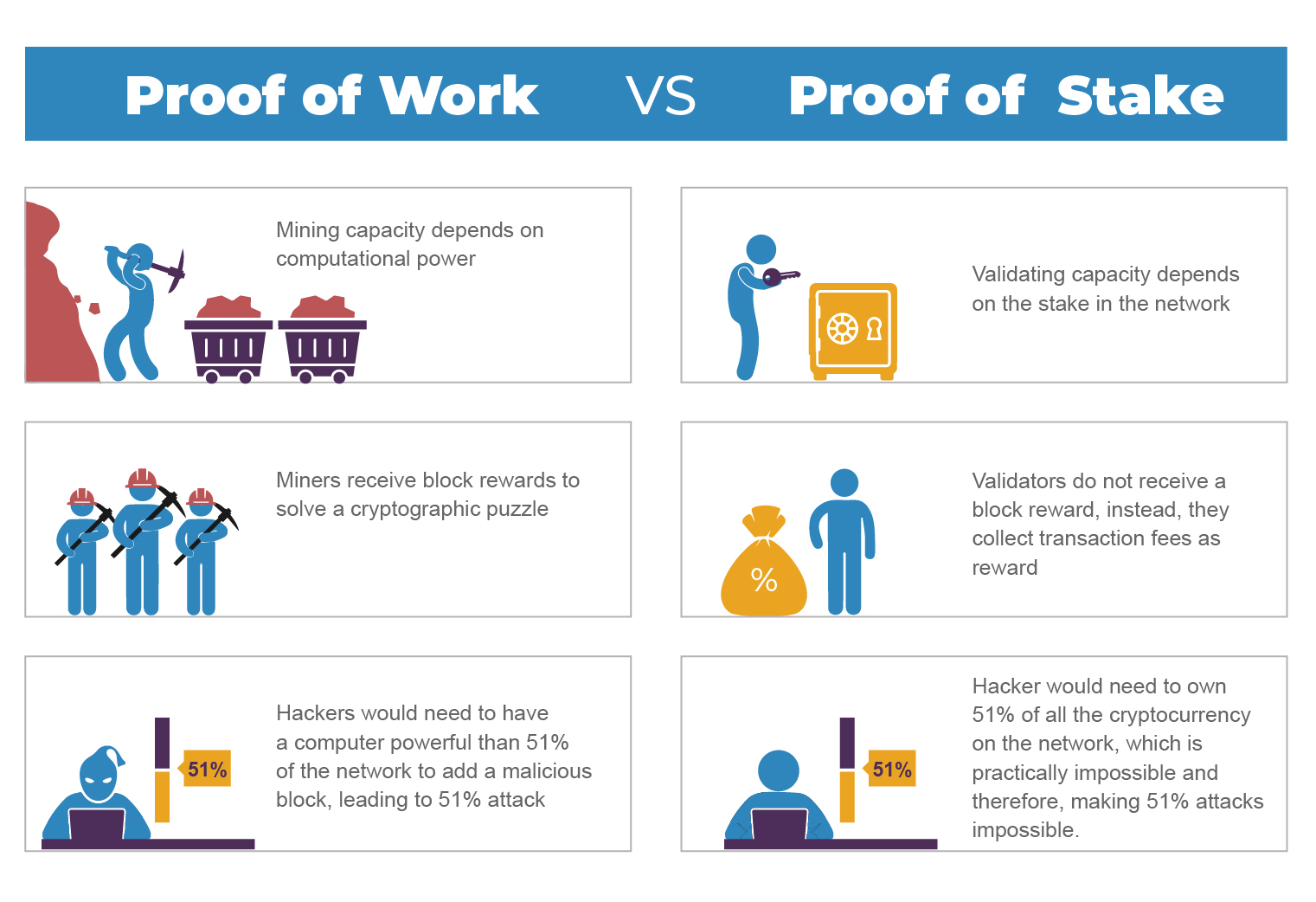

These are the two primary methods networks use to validate transactions and secure the blockchain.

Proof of Work (PoW) requires miners to solve complex mathematical puzzles using specialized hardware. The first to solve the puzzle earns the right to add the next block and receives a reward. Bitcoin uses this method. It is extremely secure but consumes significant energy.

Proof of Stake (PoS) selects validators based on the amount of cryptocurrency they have "staked" or locked up as collateral. If a validator acts dishonestly, they lose their staked funds. Ethereum transitioned from PoW to PoS in September 2022, reducing its energy consumption by over 99%. Most newer blockchains use some variation of PoS.

What Can You Do With Cryptocurrency?

The use cases have expanded far beyond speculation:

Payments. Some merchants accept Bitcoin, Ethereum, and stablecoins directly. Countries like El Salvador adopted Bitcoin as legal tender in 2021. Stablecoins are increasingly used for cross border remittances, particularly in corridors where traditional banking is slow or expensive.

Investing and Trading. Most participants treat crypto as an investment. Bitcoin ETFs launched in the U.S. in January 2024, allowing traditional investors to gain exposure through brokerage accounts. Active traders operate on centralized exchanges like Binance and Coinbase, or decentralized exchanges like Uniswap.

Decentralized Finance. DeFi protocols allow users to lend, borrow, and earn yield without intermediaries. As of 2026, the total value locked in DeFi protocols has fluctuated between $50 billion and $150 billion depending on market conditions.

NFTs and Digital Ownership. Non fungible tokens proved that blockchain can represent ownership of unique digital items, from artwork to music to real estate records. While the speculative NFT market has cooled significantly from its 2021 peak, the underlying technology continues to evolve.

Tokenized Real World Assets. An emerging trend where traditional assets like U.S. Treasury bonds, real estate, and commodities are represented as tokens on a blockchain. Major financial institutions including BlackRock and JPMorgan have launched tokenized fund products.

Risks of Cryptocurrency

Every honest guide must address the risks clearly:

Volatility. Crypto markets can swing 10% to 30% in a single day. Bitcoin dropped from over $126,000 to below $61,000 in four months during the 2025 to 2026 correction. Altcoins typically fall even harder.

Regulatory Risk. Governments worldwide are still developing frameworks for cryptocurrency. The SEC in the United States has taken enforcement action against multiple exchanges and token issuers. Regulations vary dramatically by country and can change quickly.

Security. While blockchains themselves are secure, the services built on top of them are not immune. Exchange hacks, smart contract exploits, and phishing attacks have cost users billions of dollars over the years. Self custody requires careful management of private keys.

Scams. The crypto space attracts bad actors. Rug pulls, Ponzi schemes, and fake token launches are common, particularly with new and unaudited projects. If something promises guaranteed returns, it is almost certainly a scam.

Complexity. Managing wallets, understanding gas fees, navigating DeFi protocols, and evaluating tokenomics requires a significant learning curve. Mistakes can be costly and irreversible.

How Is Crypto Taxed?

In most jurisdictions, cryptocurrency is treated as property for tax purposes. This means every time you sell, trade, or spend crypto at a profit, you may owe capital gains tax. The specific rules vary by country, and tax reporting for crypto can be complex, especially for active traders using multiple platforms.

Keep records of every transaction. Multiple software tools exist to help track cost basis and generate tax reports. Consult a tax professional familiar with cryptocurrency in your jurisdiction.

Cryptocurrency vs. Traditional Money

The core difference comes down to control. Traditional currencies are issued and managed by central banks. They can print more money, freeze accounts, and set monetary policy. Cryptocurrency operates on code. The rules are defined in the protocol, visible to everyone, and cannot be changed without consensus from the network.

Whether this decentralized model will complement or compete with traditional finance is one of the defining questions of modern economics. What is certain is that after more than a decade and a half, cryptocurrency has moved from a niche experiment to a global asset class with real institutional participation, real regulatory attention, and real consequences for those who participate.

This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.