What Is Bitcoin Halving and Why Does It Matter?

Bitcoin halving cuts the mining reward in half roughly every four years. It's the single most important supply mechanism built into Bitcoin's code — and historically, it has preceded massive price runs.

Every 210,000 blocks, Bitcoin's protocol automatically reduces the reward that miners receive for validating transactions. This event, known as halving, is baked directly into Bitcoin's source code by its pseudonymous creator, Satoshi Nakamoto. The purpose is straightforward: control the rate at which new BTC enters circulation and enforce a hard cap of 21 million coins.

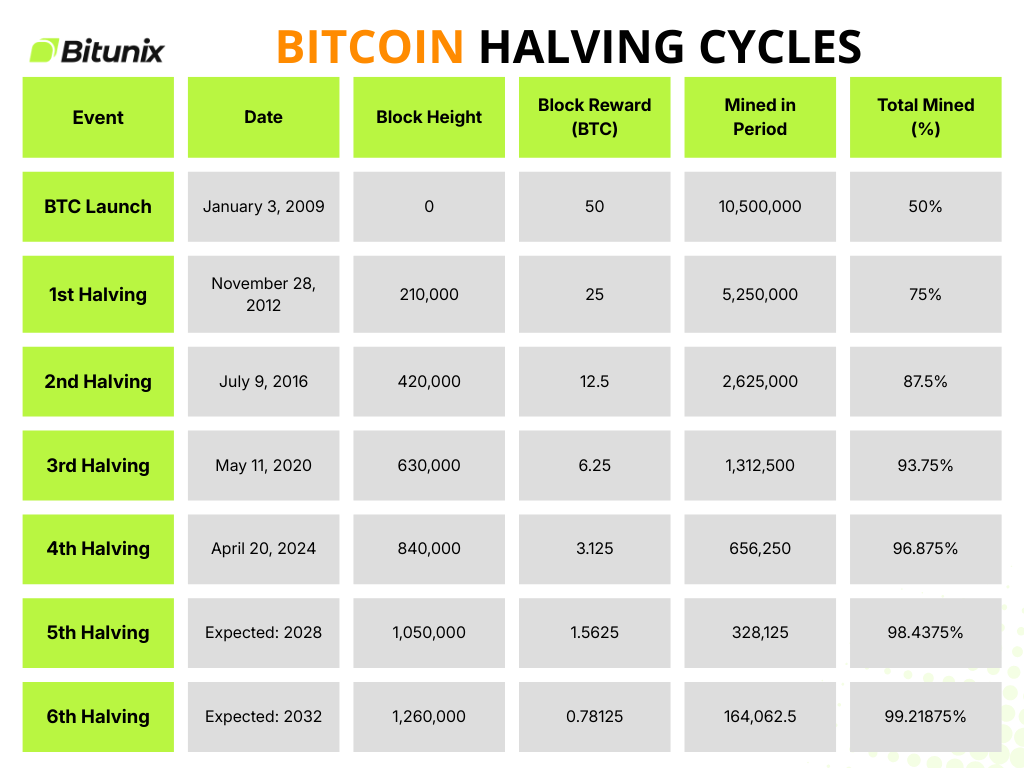

As of February 2026, there have been four halvings since Bitcoin launched in 2009. The most recent one took place on April 19, 2024, dropping the block reward from 6.25 BTC to 3.125 BTC. The next halving is projected for sometime around 2028, when the reward will fall to 1.5625 BTC per block.

How Bitcoin Mining and Block Rewards Work?

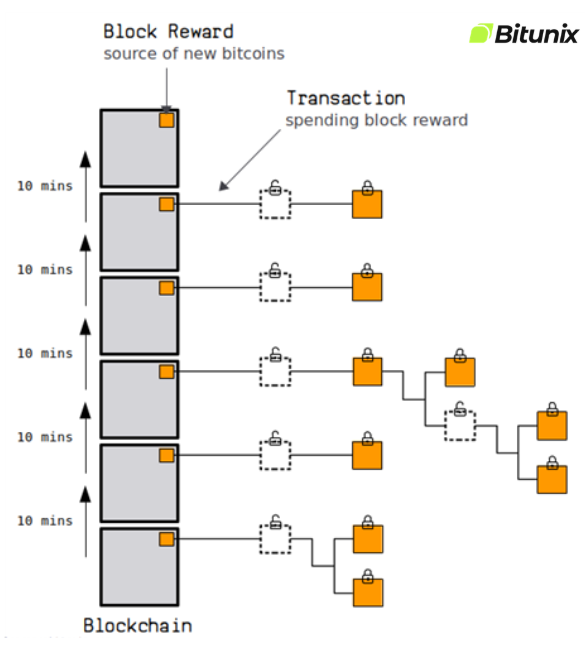

Bitcoin runs on a decentralized network where miners compete to solve complex mathematical puzzles. The first miner to solve a puzzle adds a new block of transactions to the blockchain and collects a reward in BTC.

When Bitcoin launched in January 2009, that reward was 50 BTC per block. At today's prices — with BTC trading around $66,000 in mid-February 2026 — that would be worth roughly $3.3 million per block. Back then, it was worth almost nothing.

The halving mechanism ensures that Bitcoin's inflation rate decreases over time. Currently, about 19.99 million BTC are already in circulation out of the maximum 21 million. The final bitcoin is estimated to be mined around the year 2140.

Every Bitcoin Halving So Far

Here's how each halving played out:

November 28, 2012 — Block reward dropped from 50 to 25 BTC. Bitcoin was trading around $12 at the time. Within a year, it reached over $1,000.

July 9, 2016 — Reward cut from 25 to 12.5 BTC. BTC was around $650. By December 2017, it had climbed past $19,000.

May 11, 2020 — Reward reduced from 12.5 to 6.25 BTC. BTC sat near $8,700. It eventually hit $69,000 in November 2021.

April 19, 2024 — Reward halved from 6.25 to 3.125 BTC. Bitcoin was trading around $64,000. It surged to an all-time high above $126,000 by October 2025.

The pattern is consistent but not guaranteed. Each halving has preceded a significant bull run — though the timing and magnitude vary.

Why Halving Affects Bitcoin's Price

The logic is rooted in basic supply and demand. When the supply of newly minted BTC is cut in half while demand stays the same or grows, prices tend to rise.

Scarcity intensifies. Every halving brings Bitcoin closer to its 21 million cap. Fewer new coins entering the market means existing supply becomes more valuable — similar to how limited-edition assets appreciate over time.

Mining costs increase. When rewards shrink, miners need higher BTC prices to stay profitable. Those who can't cover electricity and hardware costs exit the network, reducing sell pressure from miners dumping freshly earned coins.

Market psychology kicks in. Halvings generate attention. Media coverage, social media discussions, and historical patterns attract new buyers. This creates a self-reinforcing cycle of demand.

However, it's worth noting that correlation doesn't equal causation. Macro factors like interest rates, regulatory developments, and institutional adoption (such as the Bitcoin spot ETFs launched in 2024 and Solana ETFs in late 2025) also play major roles.

The 2024 Halving in Context

The April 2024 halving was unique because it happened in an already bullish environment. Spot Bitcoin ETFs had launched in January 2024, bringing billions in institutional money. By the time the halving hit, BTC was already near its previous all-time high.

The post-halving rally pushed Bitcoin above $126,000 in October 2025. But since then, the market has corrected significantly — BTC dropped below $70,000 in early February 2026 amid broader sell-offs and ETF outflows. As of mid-February 2026, it trades around $66,000.

This correction aligns with historical patterns. Analyst Steven McClurg of Canary Capital noted that 2026 could represent a "bear leg" in Bitcoin's four-year cycle — a natural cooldown after the post-halving euphoria.

What Happens After All Bitcoin Is Mined?

Once the 21 million cap is reached (around 2140), miners will no longer receive block rewards. Instead, they'll rely entirely on transaction fees to sustain the network.

This raises questions about network security in the far future, but for now, the combination of block rewards and transaction fees keeps miners incentivized. The transition will be gradual — each halving reduces the reward incrementally, giving the ecosystem decades to adapt.

Looking Ahead: The 2028 Halving

The next halving is expected around 2028 and will cut the reward to 1.5625 BTC per block. If history rhymes, we may see another accumulation phase leading up to the event, followed by a supply squeeze and price appreciation.

But markets evolve. Institutional participation, regulatory frameworks, and competing assets like Ethereum and Solana mean Bitcoin doesn't operate in a vacuum anymore. The 2028 halving will unfold in a very different landscape than any previous one.

Bottom Line

Bitcoin halving is the protocol's built-in mechanism for enforcing digital scarcity. It has historically been one of the strongest catalysts for BTC price appreciation, though past performance never guarantees future results.

For anyone holding or considering Bitcoin, understanding halving is essential. It's not just a technical event — it shapes market cycles, mining economics, and investor sentiment across the entire crypto industry.