What Is a Smart Contract? The Code That Kills the Middleman

No lawyers. No banks. Just code that keeps its promises.

Every time you use a decentralized exchange, mint an NFT, or earn interest through a lending protocol, a smart contract is doing the work. You just do not see it.

Here is the problem. The term gets thrown around constantly, but almost nobody explains it clearly. Most guides either drown you in developer jargon or stay so vague that you leave knowing less than when you started.

This guide strips the concept down to its core. You will learn what a smart contract is, how it works, where it is used today, what can go wrong, and why this technology is projected to grow into a $12 billion industry by 2032. Plain language. Real examples. No filler.

What Is a Smart Contract in Simple Terms?

A smart contract is a program stored on a blockchain that automatically executes an agreement when specific conditions are met. No middleman is involved. The code is the contract. The blockchain enforces it.

Think of a vending machine. You insert money. You press a button. The machine delivers the product. No negotiation. No trust required. The machine follows the rules every time. A smart contract works the same way, except instead of delivering snacks, it can transfer millions of dollars, issue tokens, manage loans, or execute insurance payouts.

The term was first coined in 1994 by computer scientist Nick Szabo, more than a decade before Bitcoin existed. Szabo imagined digital agreements that could enforce themselves without relying on courts or lawyers. But the technology to make it real did not arrive until 2015, when Ethereum launched as the first blockchain platform designed specifically to run smart contracts.

Today, smart contracts are the invisible engine behind nearly everything in crypto. Every DeFi loan. Every NFT sale. Every token swap. Every DAO vote. All of it runs on smart contracts.

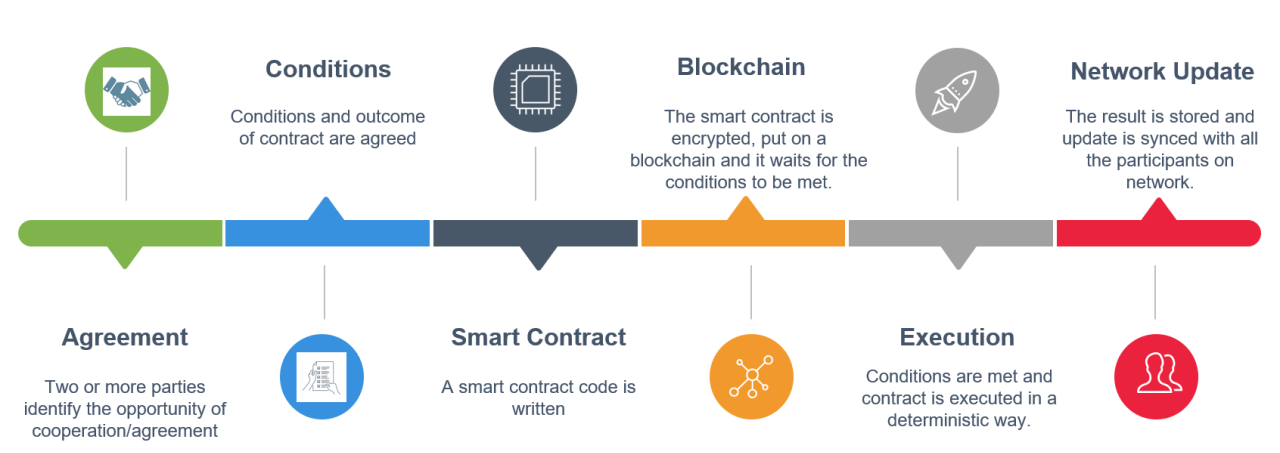

How Does a Smart Contract Work?

A smart contract works by executing preprogrammed instructions on a blockchain whenever a transaction triggers its conditions. The logic follows a simple if/then structure: if condition X is met, then execute action Y.

Here is the step by step process:

Step 1: A developer writes the contract. On Ethereum, the most common language is Solidity, which is similar to JavaScript. On Solana, developers use Rust. The code defines the rules of the agreement.

Step 2: The contract is compiled and deployed. The human readable code gets converted into bytecode (machine instructions) and uploaded to the blockchain. Once deployed, the contract lives at a specific address. It is public. Anyone can read it. Anyone can interact with it.

Step 3: Users interact with it. When someone sends a transaction to the contract's address, the Ethereum Virtual Machine (EVM) processes the logic. The same inputs always produce the same outputs. Every node on the network verifies the result.

Step 4: The contract executes automatically. If the conditions are met, the contract performs the specified action. Transfer funds. Mint a token. Liquidate collateral. Issue a payout. No human approval needed.

Once deployed, a standard smart contract cannot be changed. The code is immutable. This is a feature, not a bug. It means nobody can alter the rules after the fact. You see the code. You verify the logic. You decide whether to interact.

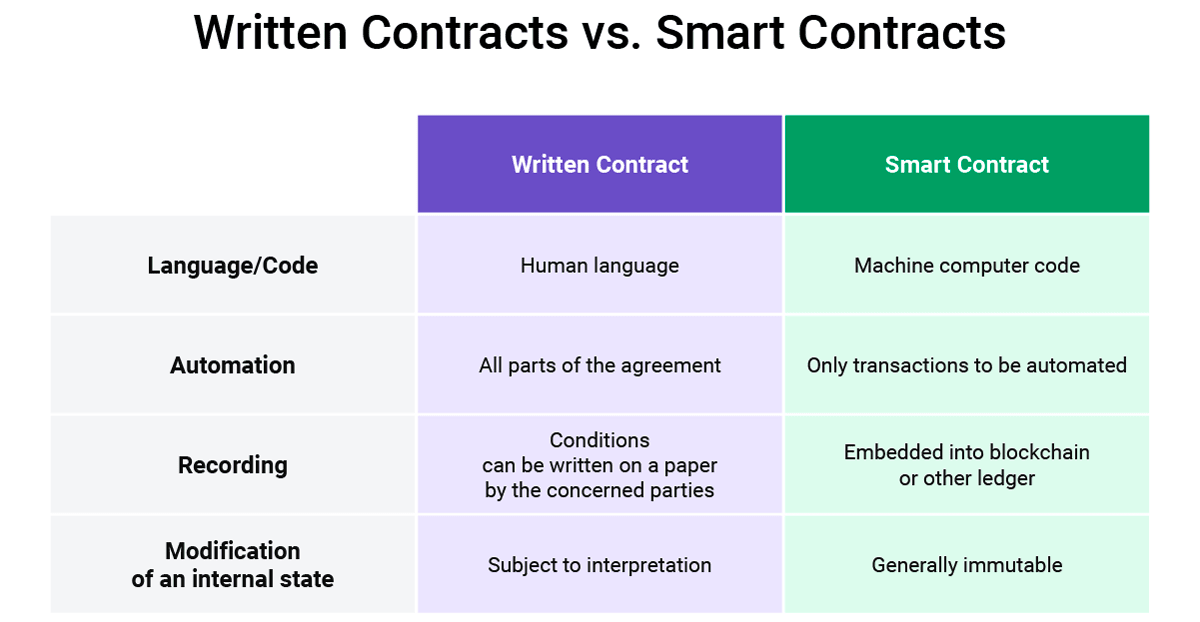

What Makes Smart Contracts Different From Regular Contracts?

Smart contracts enforce agreements through code and cryptography, while traditional contracts rely on legal systems, courts, and human intermediaries.

The differences are fundamental:

Execution. A traditional contract is a document. It describes what should happen. If someone breaks the agreement, you hire a lawyer and go to court. A smart contract does not describe what should happen. It makes it happen. Automatically.

Speed. Settling a securities trade on Wall Street takes two business days (T+2). Settling the same trade through a smart contract takes seconds.

Cost. Traditional contracts require lawyers, notaries, escrow agents, and administrative staff. A smart contract requires gas fees, often measured in cents on Layer 2 networks.

Trust. Traditional contracts require you to trust the other party or the legal system. Smart contracts require you to trust the code and the blockchain. You verify the code before interacting. If the logic is sound, the outcome is guaranteed.

Transparency. Traditional contracts are private documents between parties. Smart contracts are public. Anyone can read the code on a block explorer like Etherscan.

Limitation. Traditional contracts handle nuance, context, and human judgment. Smart contracts cannot. They only understand data that exists on the blockchain or is fed to them through external sources called oracles.

Where Are Smart Contracts Used in 2026?

Smart contracts power DeFi, NFTs, DAOs, insurance, supply chains, real estate, and an expanding list of industries that benefit from automated, trustless execution.

Decentralized Finance (DeFi)

This is the largest use case by far. DeFi protocols use smart contracts to replicate financial services without banks.

Lending and borrowing. Aave uses smart contracts to match lenders with borrowers automatically. Users deposit collateral. The contract calculates interest rates in real time. If collateral drops below a threshold, the contract liquidates the position to protect lenders. No loan officer. No credit check. Aave holds approximately $27 billion in total value locked.

Decentralized exchanges. Uniswap uses smart contracts to create automated market makers (AMMs). Users deposit token pairs into liquidity pools. The contract sets prices mathematically based on the ratio of tokens in the pool. Anyone can trade against the pool, 24/7, without permission.

Stablecoins. MakerDAO uses smart contracts to manage DAI, a decentralized stablecoin pegged to $1. Users lock up ETH as collateral and mint DAI against it. The contract handles stability, interest rates, and liquidations automatically.

NFTs (Non Fungible Tokens)

Every NFT is created, transferred, and sold through a smart contract. The ERC 721 standard on Ethereum defines how unique digital assets work. When you buy an NFT, the smart contract transfers the token to your wallet and sends payment to the seller in a single atomic transaction. Both happen or neither does.

DAOs (Decentralized Autonomous Organizations)

DAOs use smart contracts to govern communities through code. Token holders vote on proposals. The winning outcome executes automatically. Treasury management, protocol upgrades, and funding decisions all happen on chain without a CEO or board of directors.

Insurance

Parametric insurance contracts pay out automatically when an observable event occurs. A crop insurance contract can use weather data from an oracle: if rainfall drops below a defined level, the farmer gets paid immediately. No claims adjuster. No paperwork. No waiting.

Real Estate

Smart contracts can automate escrow, payment releases, and ownership transfers in property transactions. Several proptech platforms are already using them for rental agreements, where rent is transferred automatically and deposits return upon contract completion.

Supply Chain

Smart contracts track goods across global supply chains. IoT sensors record shipment data on the blockchain. The contract verifies delivery milestones, releases payments, and flags anomalies in real time.

The global smart contract market was valued at approximately $2.14 billion in 2024 and is projected to reach over $12 billion by 2032, growing at roughly 24% per year. Finance, healthcare, logistics, and real estate are leading adoption.

What Are Oracles and Why Do Smart Contracts Need Them?

Oracles are services that feed real world data into smart contracts, solving the fundamental problem that blockchains cannot access external information on their own.

A smart contract can only read data that exists on its blockchain. It cannot check a stock price, read a weather report, verify a sports score, or confirm a delivery. This limitation is called the oracle problem.

Chainlink is the dominant oracle provider. It operates decentralized oracle networks that deliver price feeds, proof of reserves, weather data, sports results, and verifiable randomness to smart contracts across multiple blockchains. Billions of dollars in DeFi depend on Chainlink data feeds.

The reliability of oracles is critical. A smart contract is only as trustworthy as the data it receives. If an oracle delivers a wrong price to a lending protocol, it could trigger false liquidations or enable an exploit. Oracle manipulation has been the attack vector behind several of the largest DeFi hacks in history.

Which Blockchains Support Smart Contracts?

Ethereum is the original and still the largest smart contract platform, hosting approximately 68% of total DeFi value locked as of early 2026.

Here are the major platforms:

Ethereum invented the smart contract blockchain. Developers use Solidity. The EVM processes all logic. Over 280,000 tokens and thousands of DeFi protocols run on it. Its Layer 2 networks (Arbitrum, Optimism, Base, zkSync) extend Ethereum's smart contract capabilities with lower fees and faster execution.

Solana takes a different approach. Smart contracts on Solana (called programs) are written in Rust. The network processes thousands of transactions per second at fractions of a penny. Speed and low cost make it popular for high frequency DeFi and consumer applications.

Avalanche offers customizable subnets for enterprise deployments. Companies can launch their own blockchain environments while still connecting to the broader ecosystem.

Cardano uses a research driven approach with formal verification methods designed to reduce bugs in smart contract code.

Polkadot enables independent blockchains to share data and communicate through a relay chain architecture.

The EVM has become an industry standard. Many competing chains are EVM compatible, meaning a smart contract written for Ethereum can be deployed on Arbitrum, Avalanche, or dozens of other networks with minimal changes. This portability is a major advantage for developers.

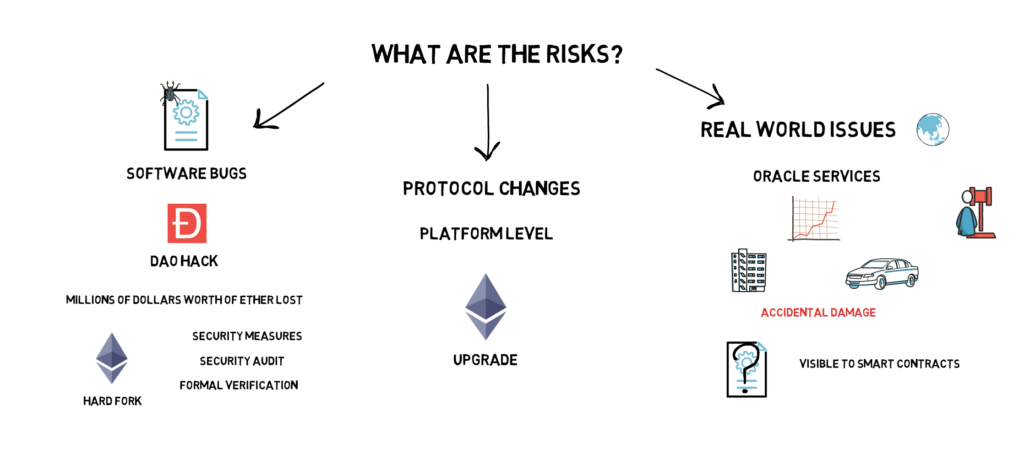

What Are the Biggest Risks of Smart Contracts?

Smart contract risks include code vulnerabilities, oracle manipulation, composability failures, upgrade abuse, and regulatory uncertainty.

Code Bugs

Smart contracts are software. Software has bugs. The difference is that a deployed smart contract cannot be patched like a regular app. If a flaw exists, attackers can exploit it before anyone can fix it.

The most famous example is The DAO hack in 2016. A reentrancy bug in the contract allowed an attacker to drain $60 million in ETH from the protocol. The Ethereum community voted to hard fork the chain to reverse the damage, splitting the network into Ethereum (ETH) and Ethereum Classic (ETC). This remains one of the most debated events in blockchain history.

Oracle Attacks

Flash loan attacks often exploit oracle vulnerabilities. An attacker borrows a massive amount of crypto in a single transaction, manipulates a price feed, profits from the distortion, and repays the loan. All in one block. All automated through smart contracts themselves.

Composability Risk

DeFi protocols interact with each other. A loan on Aave might use a price feed from Chainlink and collateral from Lido. This composability is powerful when everything works. But a failure in one contract can cascade across connected protocols. One vulnerable link can cause systemic damage.

Upgrade Abuse

Some smart contracts include proxy patterns or admin keys that allow the deploying team to modify the code after launch. This flexibility is sometimes necessary for bug fixes. But it also means the team can change the rules. If a developer retains the ability to drain funds or alter terms, the "trustless" promise breaks.

Regulatory Uncertainty

Governments are still figuring out how to regulate smart contracts. Who is liable when a bug causes millions in losses? How do you enforce KYC on a permissionless protocol? How do you tax yield generated by a contract? These questions remain largely unanswered in most jurisdictions.

Are Smart Contracts Legally Binding?

Smart contracts are legally recognized in some jurisdictions but not universally, and their legal enforceability depends on local laws and the specific nature of the agreement.

Several US states, including Arizona, Tennessee, and Wyoming, have passed legislation recognizing smart contracts as legally valid. The European Union is developing regulatory frameworks under MiCA (Markets in Crypto Assets) that address aspects of smart contract activity. Switzerland and Singapore have also implemented favorable regulations.

However, most legal systems were designed for contracts written in human language, interpreted by humans, and enforced by courts. A smart contract written in Solidity does not neatly fit into these frameworks. The gap between code and law is closing, but it is not closed.

In practice, many DeFi protocols operate in a legal gray zone. Users interact with code, not companies. There is often no formal agreement, no terms of service, and no jurisdiction specified. This creates ambiguity that regulators worldwide are working to resolve.

How Are Smart Contracts Audited?

Smart contract audits are professional code reviews performed by security firms to identify vulnerabilities before or after deployment.

Top auditing firms include Trail of Bits, OpenZeppelin, Certik, Consensys Diligence, and Spearbit. These teams review smart contract code line by line, test for known attack patterns, check logic flaws, and verify that the contract behaves as intended under edge cases.

An audit typically costs between $5,000 and $500,000 depending on the complexity of the protocol. Major DeFi projects often undergo multiple audits from different firms.

But an audit is not a guarantee of safety. Some of the most expensive hacks in crypto history hit contracts that had been audited. Audits reduce risk. They do not eliminate it.

The best practice is to check whether a project has been audited, read the audit report, and understand what risks remain. Reputable projects publish their audit reports publicly.

What Is the Future of Smart Contracts?

The future of smart contracts includes AI integration, cross chain interoperability, enterprise adoption, and deeper regulatory clarity.

AI and smart contracts are converging. AI agents that can read, deploy, and interact with smart contracts are a breakout narrative in 2026. Enterprises are experimenting with AI driven contract optimization that adjusts terms in real time based on market data.

Cross chain functionality is improving. Protocols are building bridges and messaging systems that allow smart contracts on different blockchains to communicate. A contract on Ethereum can trigger an action on Solana. This interoperability expands what is possible.

Enterprise adoption is accelerating. Banks are testing smart contracts for trade settlement. Insurance companies are automating claims. Healthcare systems are using them for patient data management and clinical trial processes. UniCredit announced a tokenized structured note on a public blockchain in late 2025, a concrete example of institutional smart contract adoption.

Regulatory frameworks are forming. The CLARITY Act in the US, MiCA in Europe, and similar legislation worldwide are creating legal structures around smart contract activity. Clearer rules attract more institutional capital.

The global smart contract market is growing at roughly 24% per year. The technology is no longer experimental. It is operational infrastructure that processes billions of dollars every day.

The Bottom Line

A smart contract is a program that replaces the middleman. It takes agreements that traditionally require lawyers, banks, and escrow agents, and executes them automatically through code on a blockchain.

The technology powers $105 billion in DeFi deposits. It secures billions in NFT transactions. It governs communities of thousands through DAOs. And it is expanding into insurance, real estate, supply chains, and healthcare.

Is it perfect? No. Bugs cost millions. Oracles can fail. Regulators are still catching up. But every year, the code gets better, the audits get stronger, and more of the global economy moves on chain.

Smart contracts do not just automate agreements. They remove the need for trust between strangers. That is not a small thing. That is the foundation of a different kind of financial system.

This article is for educational purposes only and does not constitute financial or legal advice. Smart contract interactions carry risk. Always verify code and conduct your own research before interacting with any protocol.