Cryptocurrency Exchange Fees Comparison 2026: Every Cost, Every Platform, One Clear Answer

Stop overpaying. Start comparing.

Trading fees eat your profits. Every single day. A 0.1% difference on a $10,000 monthly volume costs you $120 a year. Scale that to $100,000 and you are bleeding $1,200 for nothing.

Most traders never check the full fee picture. They see a low maker fee, sign up, and then get hit with withdrawal charges, hidden spreads, and fiat deposit costs that quietly destroy their returns.

This guide fixes that. We compared 15 major cryptocurrency exchanges across every fee category that matters: spot trading, futures, withdrawals, deposits, and token discount programs. Everything is updated for February 2026.

No affiliate bias. No sponsored rankings. Just the numbers.

What Are Crypto Exchange Fees and Why Do They Matter?

Crypto exchange fees are the costs you pay every time you buy, sell, deposit, or withdraw digital assets on a trading platform. These fees vary dramatically between exchanges and can mean the difference between a profitable year and a losing one.

Here is what most traders miss. The advertised trading fee is rarely your actual cost. Your real expense is a combination of trading commissions, spreads, withdrawal charges, and deposit processing fees. An exchange with 0% trading fees can still be expensive if it buries costs in wider spreads.

Understanding the full fee stack is the single most impactful thing you can do to protect your portfolio in 2026.

How Do Maker and Taker Fees Work?

A maker fee is charged when your order adds liquidity to the order book. A taker fee is charged when your order removes liquidity by filling immediately.

When you place a limit order at a price that does not execute right away, you are a maker. You are creating (making) the market. Exchanges reward this with lower fees.

When you place a market order that executes instantly, you are a taker. You are consuming (taking) existing liquidity. This costs more.

Most exchanges use a tiered system. The more you trade in a 30 day window, the lower your fees drop. Some platforms also offer additional discounts if you hold their native token.

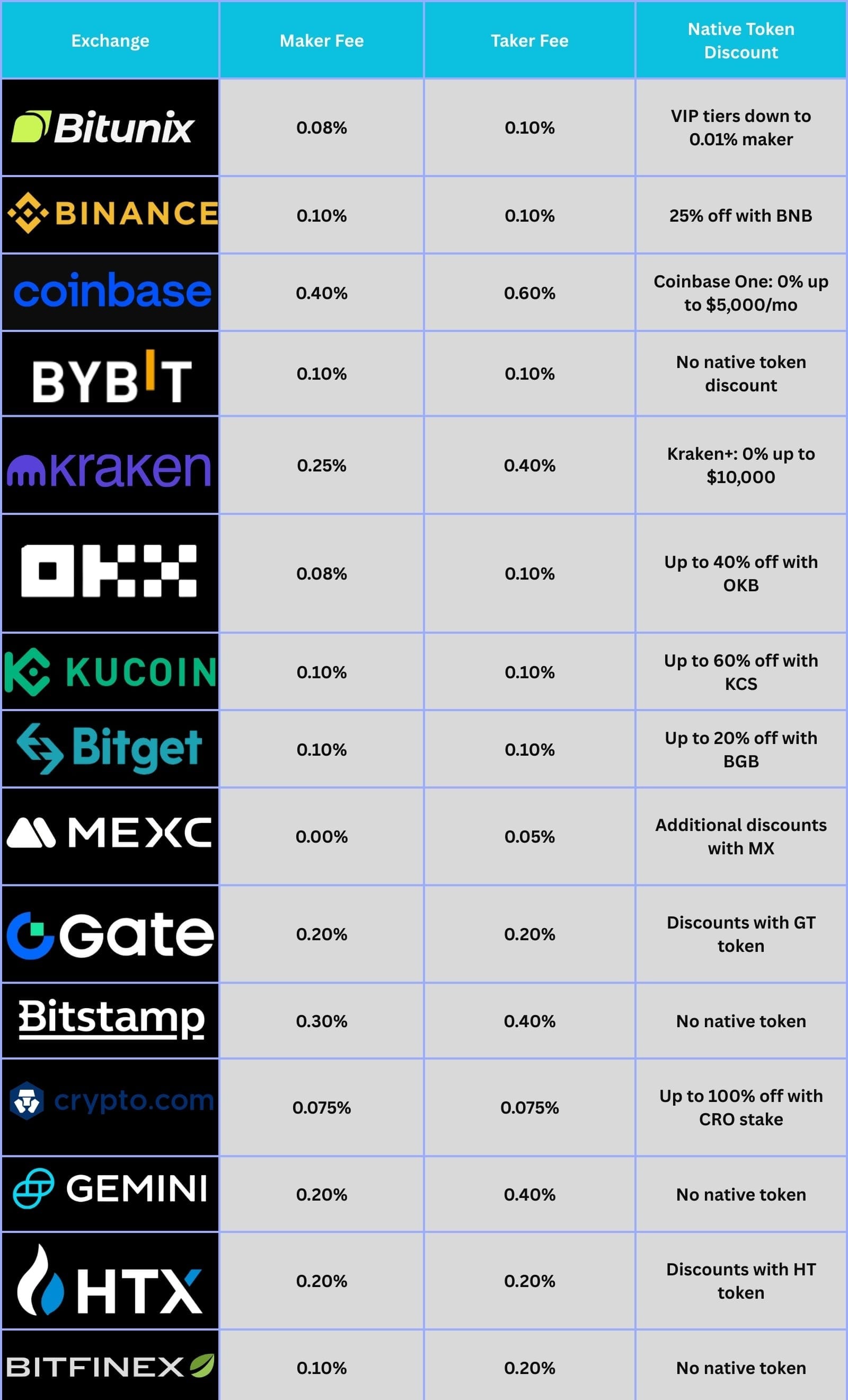

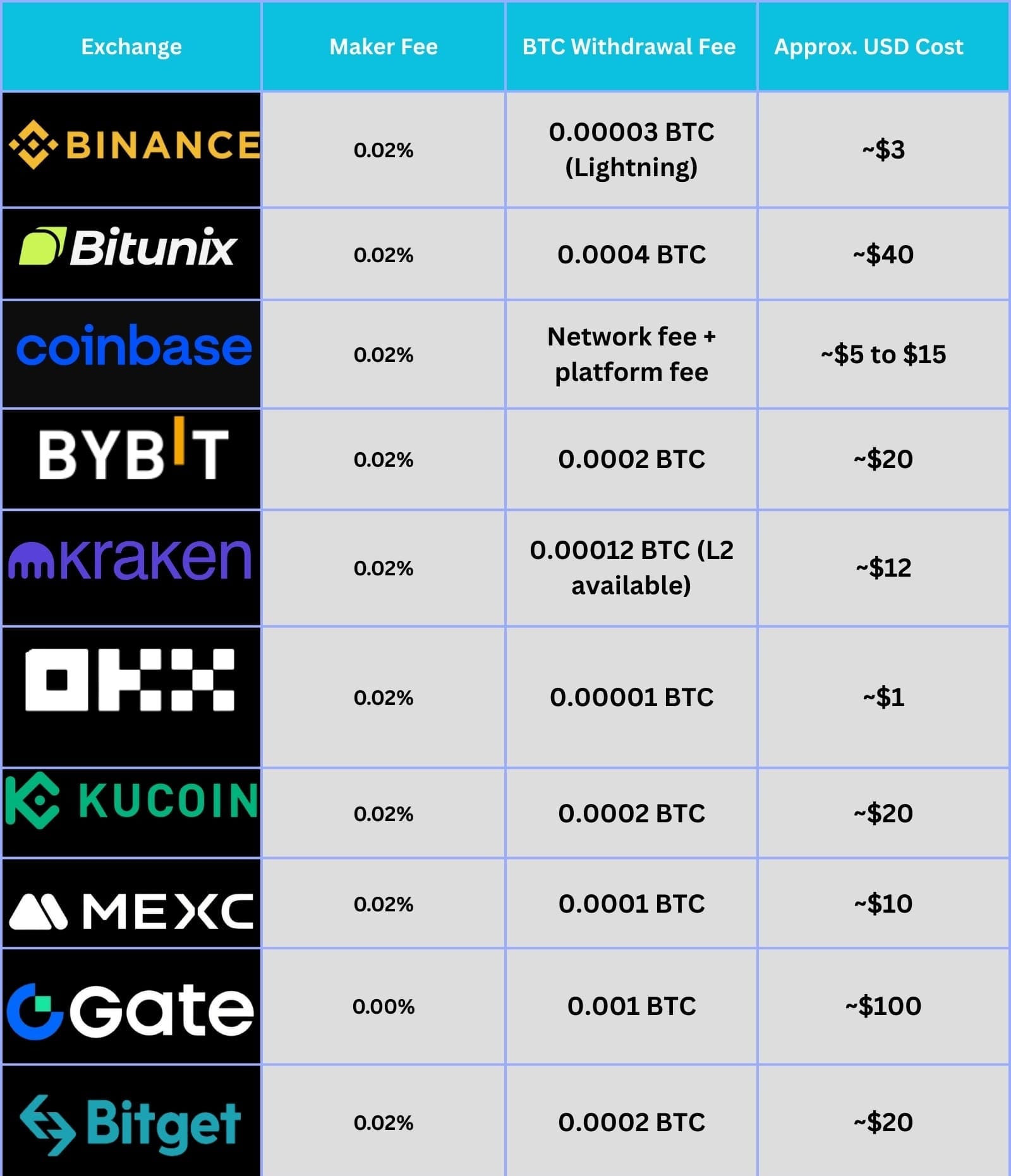

Complete Crypto Exchange Fee Comparison Table (2026)

Below is a side by side breakdown of base tier fees across 15 major exchanges. These are the fees a new user pays before any volume discounts or token holdings.

Spot Trading Fees (Base Tier)

Futures Trading Fees (Base Tier)

Which Exchange Has the Lowest Trading Fees in 2026?

MEXC currently offers the lowest trading fees in 2026 with 0% maker and 0.05% taker for spot, and 0% maker and 0.01% taker for futures.

However, the lowest fee does not always mean the lowest total cost. MEXC may have wider spreads on certain pairs or fewer fiat on ramps compared to larger platforms. Here is how the top contenders stack up for the average trader:

For casual spot traders (under $10,000/month): Kraken+ and Coinbase One both offer zero fee trading up to set monthly limits. If you trade within those caps, your effective fee is literally 0%.

For active spot traders ($10,000 to $100,000/month): OKX offers the best base rates at 0.08% maker and 0.10% taker. Combine that with OKB holdings for an additional 40% discount, and your effective rate drops to roughly 0.048% maker.

For high volume futures traders: MEXC leads with zero maker fees. Binance and Kraken follow closely at 0.02% maker. The real differentiator at this level is liquidity and execution speed, not fees alone.

Bitunix: The Rising Low Fee Exchange Traders Are Switching To

Bitunix has quietly become one of the most cost effective exchanges in 2026, offering 0.08% maker and 0.10% taker for spot, and 0.02% maker and 0.06% taker for futures. Those base rates already beat Binance, Kraken, Coinbase, Gate.io, and Gemini on spot right out of the gate.

But the real story is the VIP tier system. Unlike most exchanges that require you to hold a native token for discounts, Bitunix drops your fees purely based on 30 day trading volume or account balance. No token purchase needed. No extra price exposure risk.

Here is what makes Bitunix stand out from the crowd:

Lower base spot fees than most competitors. At 0.08% maker, Bitunix matches OKX and beats Binance (0.10%), Bybit (0.10%), Kraken (0.25%), Coinbase (0.40%), and Gate.io (0.20%). For taker fees at 0.10%, it is on par with Binance and Bybit, and significantly cheaper than Kraken (0.40%) and Coinbase (0.60%).

VIP 7 spot maker fee drops to 0.01%. That is one of the lowest rates available at any exchange globally. Even Bitfinex, known for competitive high volume rates, charges 0.02% at its top tier. Bitunix cuts that in half.

No mandatory KYC for basic trading. Privacy focused traders can start trading immediately without identity verification. This is a major advantage for users who value anonymity and speed.

Free copy trading. Bitunix does not charge platform fees for copying trades from experienced lead traders. You only share a percentage of your profits with the lead trader. Nearly 2,000 lead traders are available on the platform, with transparent performance metrics including ROI, win rate, and historical positions.

700+ listed cryptocurrencies. Bitunix provides solid altcoin coverage with over 700 tokens and growing. While not as large as MEXC (3,100+) or Gate.io (2,000+), the selection covers all major assets and a strong range of emerging tokens.

Strong security with no major breaches. Despite being founded in 2021, Bitunix holds a BBB security rating on CER.live, is ranked 35th among global exchanges, and has never suffered a significant hack. The platform publishes proof of reserves regularly.

Competitive futures trading. With 0.02% maker fees on perpetual contracts and leverage up to 125x, Bitunix matches Binance, Kraken, and OKX on futures maker rates. The platform reports billions in daily trading volume, which means adequate liquidity for most trading pairs.

Who Should Use Bitunix?

Bitunix is best suited for active spot and futures traders who want low fees without buying a native exchange token. It is also an excellent choice for privacy focused traders, copy trading enthusiasts, and anyone who values a straightforward fee structure with clear VIP progression.

The one area where Bitunix falls short is fiat on ramps. Direct fiat deposits are limited to cards and SEPA (EU), and third party payment providers charge 2% to 6%. If you primarily fund with stablecoins or crypto transfers, this is not an issue.

Bottom line: For pure trading cost efficiency, Bitunix ranks among the top 5 cheapest exchanges in 2026. When you factor in its no token requirement, privacy features, and free copy trading, it becomes a compelling alternative to established names like Binance, OKX, and Bybit.

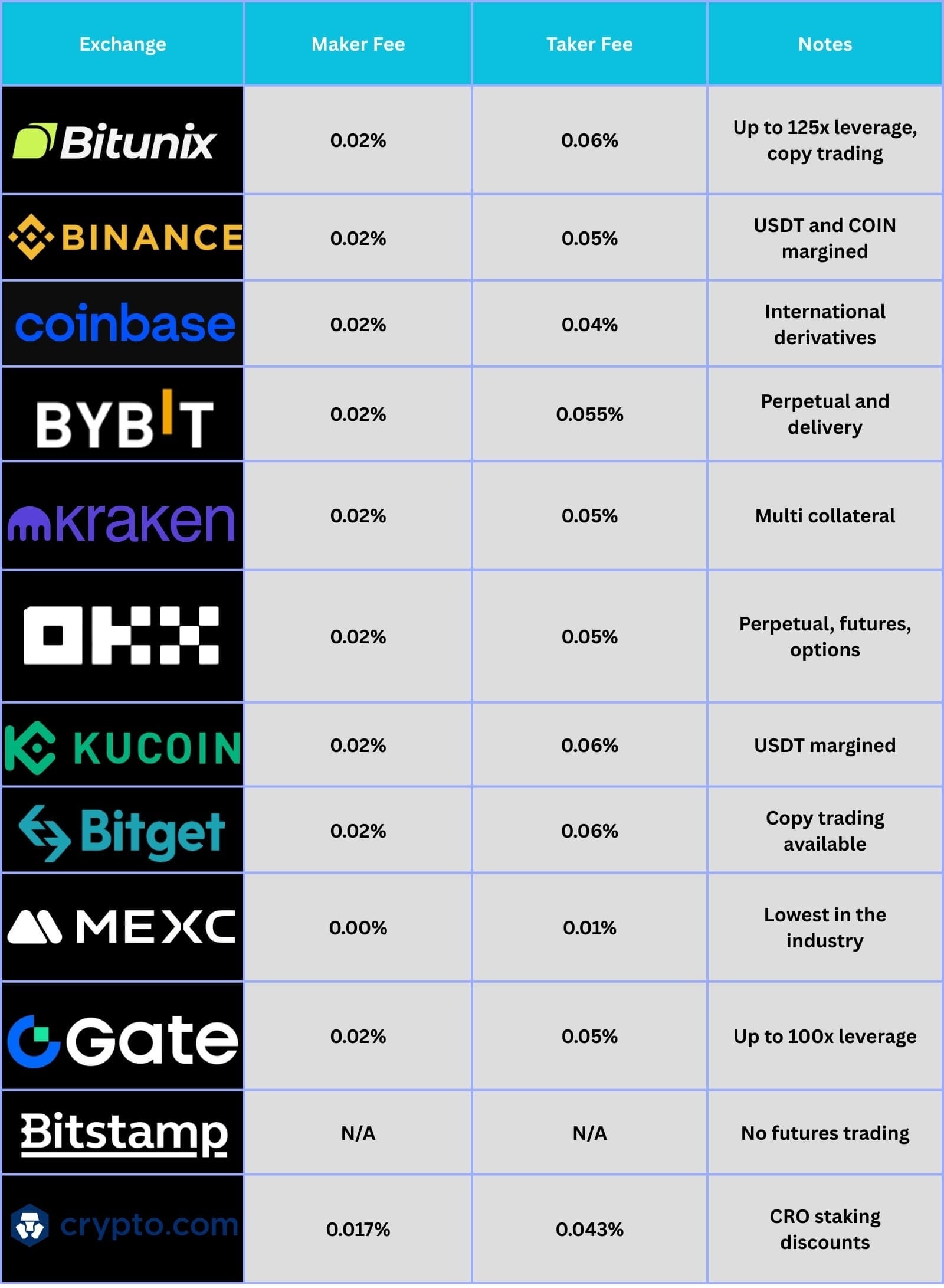

Withdrawal Fees: The Hidden Cost Most Traders Ignore

Withdrawal fees are fixed charges applied when you move crypto from an exchange to an external wallet. These vary by coin and network, not by the amount you withdraw.

This is where many "low fee" exchanges quietly make their money. A platform with zero trading fees but a $25 BTC withdrawal charge can cost more than one with 0.10% trading fees and a $2 withdrawal.

Bitcoin Withdrawal Fees by Exchange

Note: USD estimates based on BTC price of approximately $100,000. Actual costs fluctuate with network congestion and BTC price.

Key insight: OKX and Binance consistently offer the lowest crypto withdrawal fees. Gate.io charges significantly more for BTC withdrawals. If you frequently move Bitcoin off exchange, this single cost can outweigh months of trading fee savings.

Pro Tip: Use Layer 2 Networks to Slash Withdrawal Costs

Many exchanges now support withdrawals via Lightning Network (for BTC), Arbitrum, Optimism, and Base (for ETH and ERC20 tokens). These L2 options can reduce your withdrawal fee by 80% to 95%.

Always check which networks an exchange supports before withdrawing. Sending USDC via Arbitrum instead of Ethereum mainnet can save you $10 or more per transaction.

Deposit Fees: What It Costs to Fund Your Account

Most exchanges offer free crypto deposits. The cost you see is the blockchain network fee, which goes to miners and validators, not the exchange itself.

Fiat deposits are a different story. Here is how the major methods compare:

Bottom line: Always use bank transfers when possible. Credit card deposits are the most expensive way to fund a crypto account. That 3.99% Coinbase card deposit fee on a $1,000 purchase costs you $39.90 before you even make a trade.

Exchange Native Token Discounts: Are They Worth It?

Holding an exchange's native token can reduce your trading fees by 20% to 100%, but it introduces a new risk: exposure to the exchange token's price.

Here is how the major discount programs work:

BNB (Binance): 25% fee discount when used to pay trading fees. BNB is one of the most liquid exchange tokens with a large market cap. Relatively low risk for the discount offered.

OKB (OKX): Up to 40% discount based on OKB holdings and trading volume. Strong utility and reasonable liquidity.

KCS (KuCoin): Up to 60% discount plus daily KCS bonus (a share of trading fees). Attractive if you are a heavy KuCoin user.

CRO (Crypto.com): Staking CRO can reduce spot fees by up to 100%. However, CRO has been volatile and staking requires a lockup period.

MX (MEXC): Additional fee reductions on already low base fees. Smaller market cap token, so higher price risk.

The verdict: BNB and OKB offer the best balance of fee savings and token stability. If you trade exclusively on one exchange and your monthly volume justifies it, holding the native token is almost always worth it.

Spread: The Invisible Fee Nobody Talks About

The spread is the difference between the buy price and the sell price of a cryptocurrency. It is an indirect cost that does not appear on any fee schedule.

Exchanges with "zero fee" instant buy features often embed their profit in wider spreads. You pay nothing in commissions but overpay 0.5% to 2% on the actual price.

How to check the spread:

- Compare the instant buy price with the spot market order book price on the same exchange

- If there is a 1% gap, that is your hidden fee

Exchanges with the tightest spreads (highest liquidity): Binance, OKX, and Bybit consistently offer the narrowest spreads on major pairs like BTC/USDT and ETH/USDT because of their massive trading volume.

Exchanges with wider spreads: Coinbase simple buy, Kraken instant buy, and Gemini ActiveTrader tend to have wider spreads, especially on smaller altcoins.

Always use the advanced or pro trading interface. Never use "simple buy" or "instant purchase" features for any amount over $100.

How to Calculate Your True Trading Cost

Your true cost per trade equals the trading fee plus half the spread, plus a proportional share of deposit and withdrawal fees.

Here is a practical example. Say you buy $5,000 worth of Bitcoin and later withdraw it.

On Binance: Trading fee: $5,000 × 0.10% = $5.00 Estimated spread cost: $5,000 × 0.05% = $2.50 BTC withdrawal (Lightning): ~$3.00 Total cost: $10.50 (0.21%)

On Coinbase (simple buy): Trading fee: $5,000 × 0.60% = $30.00 Estimated spread cost: $5,000 × 0.50% = $25.00 BTC withdrawal: ~$10.00 Total cost: $65.00 (1.30%)

That is a 6x difference on the exact same trade. Over a year of regular trading, this gap compounds into hundreds or thousands of dollars.

Best Exchange for Each Trading Style in 2026

Different traders have different needs. Here is our recommendation based on trading behavior, not marketing claims.

Best for Beginners:

Coinbase remains the easiest platform to start with. Yes, fees are higher. But the interface is intuitive, customer support exists, and it is fully regulated in the US. Once comfortable, switch to Coinbase Advanced to cut your fees in half.

Best for Active Spot Traders:

Bitunix and OKX tie for the top spot here. Both offer 0.08% maker fees, which is lower than Binance, Bybit, and every other major platform at the base tier. The key difference: OKX requires OKB holdings for additional discounts, while Bitunix offers VIP tier reductions based purely on volume or balance. If you prefer not to hold an exchange token, Bitunix is the cleaner option.

Best for Futures and Derivatives:

Bybit and Binance lead the derivatives market in 2026. Both offer 0.02% maker fees with high liquidity. Bitunix is a strong contender for futures traders who also want copy trading, offering the same 0.02% maker rate with up to 125x leverage and nearly 2,000 lead traders to follow. MEXC is the cheapest option, but its liquidity on less popular pairs can be thinner.

Best for Privacy Focused Traders:

Bitunix wins this category outright. No mandatory KYC for basic trading, generous withdrawal limits without identity verification, and competitive fees make it the top choice for traders who value anonymity. Most other major exchanges now require full KYC before you can trade.

Best for Copy Trading on a Budget:

Bitunix charges zero platform fees for copy trading. You only share profits with the lead trader you follow. Bitget also offers strong copy trading, but Bitunix's combination of no platform fee and lower base spot rates makes it more cost effective overall.

Best for Low Frequency Holders:

Kraken with its Kraken+ zero fee program (up to $10,000/month) is ideal if you buy and hold with occasional trades. Strong security track record and solid regulatory standing.

Best for Altcoin Traders:

MEXC lists over 3,100 tokens, many before other exchanges. Combined with zero maker fees, it is the go to platform for early altcoin access. Gate.io is a strong alternative with 2,000+ tokens. Bitunix with 700+ tokens offers a solid middle ground with better base fees than Gate.io.

Best for Cost Conscious Withdrawals:

OKX consistently offers the lowest withdrawal fees across most cryptocurrencies. Its support for multiple L2 networks makes it the cheapest platform to move crypto off exchange.

7 Proven Ways to Reduce Your Exchange Fees

You can cut your trading costs by 30% to 80% without switching exchanges. Here are the most effective strategies:

- Use limit orders instead of market orders. Limit orders qualify for maker fees, which are always lower. On some exchanges, the difference between maker and taker is 0.02% to 0.20%.

- Hold the exchange's native token. BNB gives 25% off on Binance. OKB gives up to 40% off on OKX. KCS gives up to 60% off on KuCoin. The math is simple.

- Increase your 30 day trading volume. Every major exchange offers volume based discounts. Consolidating your trades on one platform rather than splitting across three can push you into a lower fee tier.

- Withdraw using Layer 2 networks. Bitcoin Lightning, Arbitrum, Optimism, and Base all offer dramatically lower withdrawal costs than mainnet.

- Batch your withdrawals. Instead of withdrawing every day, accumulate and withdraw once a week or month. One $5 withdrawal fee is better than seven.

- Avoid credit card deposits. Use bank transfers (ACH, SEPA, SWIFT) whenever possible. Card deposits add 1.5% to 4% before you even trade.

- Use the advanced trading interface. Simple buy and instant purchase features have wider spreads baked in. Always trade on the exchange's pro or advanced platform.

Crypto Exchange Fees FAQ

How much do crypto exchanges charge per trade?

Most major exchanges charge between 0.02% and 0.60% per trade depending on order type, trading volume, and whether you are a maker or taker. The industry average for spot trading in 2026 is approximately 0.15% for makers and 0.19% for takers. MEXC currently offers the lowest at 0% maker and 0.05% taker. Coinbase is the most expensive major exchange at 0.40% maker and 0.60% taker (base tier).

Which crypto exchange has zero trading fees?

MEXC offers 0% maker fees on spot trading across most pairs in 2026. Binance.US offers 0% maker and 0.01% taker. Coinbase One and Kraken+ offer zero fee trading up to monthly caps ($5,000 and $10,000 respectively) through paid subscription programs. No exchange offers truly zero cost trading when you include spreads and withdrawal fees.

Are Binance fees lower than Coinbase fees?

Yes, significantly. Binance charges 0.10% for both maker and taker at the base tier. Coinbase charges 0.40% maker and 0.60% taker. With BNB discount, Binance's effective fee drops to 0.075%. That means Coinbase is roughly 5 to 8 times more expensive per trade for a standard user.

Do I pay fees when depositing crypto?

Exchanges themselves do not charge crypto deposit fees. However, you pay a blockchain network fee to send the transaction. This fee goes to validators and miners, not the exchange. The cost depends on the network. Bitcoin fees range from $1 to $10 depending on congestion. Ethereum mainnet fees can reach $5 to $50. Using L2 networks like Arbitrum keeps deposit costs under $1.

What is the cheapest way to withdraw Bitcoin from an exchange?

Using the Lightning Network is the cheapest withdrawal method for Bitcoin. Binance charges approximately 0.00003 BTC (around $3) for a Lightning withdrawal. OKX charges 0.00001 BTC (around $1) for on chain Bitcoin withdrawals, which is also very low. Avoid exchanges like Gate.io that charge 0.001 BTC (around $100) for a standard BTC withdrawal.

How do futures fees compare to spot fees?

Futures fees are generally lower than spot fees. Most exchanges charge 0.02% maker and 0.04% to 0.06% taker for futures, compared to 0.08% to 0.40% for spot. However, futures trading includes additional costs like funding rates (charged every 8 hours on perpetual contracts) and potential liquidation penalties that spot trading does not have.

Is Bitunix a good exchange for low fee trading?

Yes. Bitunix offers some of the lowest base tier fees in the industry at 0.08% maker and 0.10% taker for spot trading. These rates beat Binance (0.10%/0.10%), Kraken (0.25%/0.40%), and Coinbase (0.40%/0.60%) without requiring you to hold a native exchange token. For futures, Bitunix charges 0.02% maker and 0.06% taker, which is competitive with Binance and OKX. The VIP system reduces fees down to 0.01% maker for spot at the highest tier. Additional advantages include no mandatory KYC, free copy trading, 700+ listed tokens, and a clean security record with no major hacks since its 2022 launch.

Final Thoughts: Choosing the Right Exchange Is About Total Cost

Picking an exchange based on a single fee number is a mistake. The cheapest maker fee means nothing if the exchange charges $100 for a BTC withdrawal or hides 1% in spreads.

Here is what you should actually evaluate:

Total trading cost (fees + spread) for the pairs you trade most, withdrawal fees for the coins you hold, fiat deposit costs for your preferred funding method, liquidity depth on your target pairs, and the security track record of the platform.

For most active traders in 2026, the sweet spot lies with exchanges like Bitunix, OKX, and Binance, which combine genuinely low base fees with strong liquidity and reliable execution. Bitunix in particular deserves attention for offering top tier pricing without forcing you to buy and hold a native token, while also providing free copy trading and privacy focused access.

The best exchange for you is the one where your total annual cost is lowest for your specific trading pattern. Use the tables and formulas in this guide to run the numbers. The 20 minutes you spend comparing will save you hundreds over the next year.

Fee data in this article was verified from official exchange fee pages and third party sources as of February 2026. Exchanges update their fee schedules frequently. Always confirm current rates on the exchange's official website before making a decision.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk. Do your own research before choosing a platform or making any trades.