Coins vs Tokens vs ICOs: What Every Crypto Investor Must Understand in 2026

The cryptocurrency market in February 2026 contains over 15,000 listed assets. Some call themselves coins. Others call themselves tokens. Many launched through ICOs, IDOs, or airdrops. For most investors, these terms blur together into a single category labeled "crypto," and the distinctions feel academic.

They are not academic. They are structural. And confusing them has cost people real money.

They are not academic. They are structural. And confusing them has cost people real money.

A coin and a token operate on fundamentally different layers of blockchain architecture. An ICO and an airdrop represent completely different risk profiles and regulatory exposures. Understanding these differences is not about passing a quiz. It is about knowing what you actually own, what gives it value, and what could make it worthless.

This guide explains each concept from the ground up, starting with what it is and how it works before moving to real world examples and practical investment considerations.

What Is a Cryptocurrency Coin?

A coin is the native digital currency of an independent blockchain. It exists to serve two primary purposes within its own network: paying transaction fees and incentivizing the validators or miners who secure the chain.

The word "native" is the key distinction. A coin does not borrow infrastructure from another network. It runs on its own blockchain with its own consensus mechanism, its own set of validators, and its own economic rules. When you send Bitcoin from one wallet to another, the Bitcoin network processes that transaction using its own nodes, its own protocol, and its own fee structure. No other blockchain is involved.

This independence gives coins a specific investment profile. When you buy a coin, you are making a bet on the adoption and success of an entire blockchain network. If more people use the network, demand for the coin increases because every transaction requires it. If the network fails or becomes irrelevant, the coin loses its utility and its value.

Coins also play a role in network governance and security. On proof of stake networks, holding and staking the native coin contributes to consensus. On proof of work networks, miners earn the native coin as a reward for securing the chain. This tight integration between the coin and the network's survival creates a direct economic link that tokens do not share.

How Coins Function in Practice

Every blockchain needs a mechanism to prevent spam and compensate the people who keep it running. Coins serve this function. When you execute a transaction on Ethereum, you pay a fee in ETH. When you send Bitcoin, you pay a fee in BTC. These fees are not arbitrary charges. They are the economic fuel that keeps the network operational.

Without a native coin, a blockchain cannot function. Validators would have no incentive to process transactions. Users would have no way to pay for block space. The entire system depends on the coin having value, which creates a self reinforcing cycle: a useful network drives demand for the coin, and a valuable coin attracts more validators, which makes the network more secure, which makes it more useful.

This is why coins are often described as infrastructure investments. You are not buying a product or a service. You are buying a share of the foundational layer that everything else is built on.

Examples of Major Coins in 2026

Bitcoin (BTC) remains the original and most widely recognized cryptocurrency. Launched in 2009, it operates on its own proof of work blockchain with a fixed supply cap of 21 million coins. After the April 2024 halving reduced the mining reward to 3.125 BTC per block, Bitcoin's inflation rate dropped below 1% annually. In February 2026, BTC trades around $66,000, down from its October 2025 all time high of approximately $126,000. Its primary use case has evolved from peer to peer digital cash to a store of value and institutional reserve asset, with multiple spot ETFs now trading in the United States.

Ethereum (ETH) is the native coin of the Ethereum network, the most widely used smart contract platform in existence. Since completing its transition from proof of work to proof of stake in September 2022 (known as "The Merge"), Ethereum reduced its energy consumption by approximately 99.95%. ETH is used to pay gas fees for every transaction and smart contract execution on the network, and it serves as the staking collateral for validators securing the chain. As of February 2026, ETH trades around $1,945, with the network processing the majority of decentralized finance activity and serving as the settlement layer for most Layer 2 scaling solutions.

Solana (SOL) operates its own Layer 1 blockchain using a combination of proof of stake and proof of history consensus. The network processes thousands of transactions per second at costs typically below $0.01, making it popular for high frequency applications including DeFi, NFT marketplaces, and payment systems. SOL trades around $78 in February 2026. The launch of Solana spot ETFs in late 2025 marked a significant milestone for the network's institutional credibility.

Litecoin (LTC) has operated since 2011 on its own proof of work blockchain using the Scrypt algorithm. With 2.5 minute block times (four times faster than Bitcoin) and consistently low fees, Litecoin continues to function as a practical payment network. LTC trades around $52 in February 2026.

Each of these coins shares a common trait: they are the native, essential currency of their own independent blockchain. Remove the coin and the network cannot function.

What Is a Cryptocurrency Token?

A token is a digital asset built on top of an existing blockchain using smart contracts. Unlike coins, tokens do not have their own blockchain. They borrow the security, consensus mechanism, and transaction processing infrastructure of the chain they are deployed on.

Think of it this way. A coin is the operating system. A token is an application that runs on that operating system. The application depends on the operating system to function, but the operating system does not depend on the application. Ethereum can exist without any specific ERC-20 token. But an ERC-20 token cannot exist without Ethereum.

Tokens are created by deploying a smart contract on a compatible blockchain. The contract defines the token's name, supply, distribution rules, and transfer mechanics. Once deployed, the token lives on that blockchain and uses the blockchain's native coin to pay for transaction processing. Sending a USDT token on Ethereum requires paying gas fees in ETH. Sending a token on Solana requires paying fees in SOL. The token itself does not pay for its own infrastructure.

This architectural dependency is the single most important distinction between coins and tokens. A coin is a bet on a blockchain. A token is a bet on an application or use case that happens to run on someone else's blockchain.

Token Standards Explained

Token creation follows standardized frameworks defined by each blockchain. These standards ensure that all tokens on a given chain are compatible with the same wallets, exchanges, and applications.

ERC-20 is the most widely adopted token standard, created for the Ethereum network. It defines a set of rules that every compliant token must follow, including functions for transferring tokens, checking balances, and approving third party spending. The vast majority of tokens in the crypto ecosystem, including most stablecoins and DeFi governance tokens, use ERC-20.

BEP-20 serves the same function on BNB Chain (formerly Binance Smart Chain). It is architecturally similar to ERC-20 but operates within BNB Chain's validator set and fee structure.

SPL is the token standard for Solana. SPL tokens benefit from Solana's speed and low costs but are limited to the Solana ecosystem unless bridged to other chains.

Understanding which standard a token uses tells you which blockchain it depends on, which wallets support it, and what fees you will pay when transacting with it. A common beginner mistake is sending an ERC-20 token to a BEP-20 address or vice versa, which can result in permanent loss of funds.

Types of Tokens in 2026

The token landscape has diversified significantly since the early days of simple utility tokens. In 2026, tokens fall into several distinct categories based on their function and regulatory classification.

Utility tokens provide access to a specific product or service within a decentralized application. Holding the token is the key to using the platform. These tokens derive value from the demand for the service they unlock. If the platform attracts users, demand for the token increases. If the platform fails, the token becomes worthless regardless of its technical design.

Governance tokens grant holders voting power over protocol decisions. DAOs (Decentralized Autonomous Organizations) use governance tokens to let their communities decide on fee structures, treasury allocations, protocol upgrades, and strategic direction. The value proposition is direct influence over a protocol's future.

Stablecoins are tokens pegged to external assets, most commonly the US dollar. They maintain their peg through reserves held in bank accounts, treasury bills, or algorithmic mechanisms. Stablecoins serve as the primary medium of exchange within crypto markets, allowing traders to move in and out of volatile positions without converting back to fiat currency. In 2026, regulated stablecoins have also become a significant force in cross border payments, processing settlement faster and cheaper than traditional banking rails.

Security tokens represent ownership in real world assets such as equity, debt, or real estate. Unlike utility tokens, security tokens are explicitly classified as financial securities and fall under regulatory frameworks like the SEC's Howey Test in the United States and MiCA in the European Union. They offer investor protections including disclosure requirements and audit obligations, but they also carry compliance costs and trading restrictions that utility tokens avoid.

Non Fungible Tokens (NFTs) represent unique digital assets. Each NFT has a distinct identifier that makes it non interchangeable, unlike fungible tokens where one unit is identical to another. The use cases have expanded well beyond digital art to include identity verification, real estate deed tokenization, gaming asset ownership, and event ticketing.

Token Examples That Illustrate the Categories

UNI (Uniswap) is the governance token of Uniswap, the largest decentralized exchange by volume. UNI holders vote on protocol fee switches, treasury grants, and development priorities. The token is an ERC-20 asset on Ethereum and does not have its own blockchain.

LINK (Chainlink) powers the Chainlink oracle network, which provides external data to smart contracts. Node operators stake LINK as collateral, and dApps pay LINK to access oracle services. Despite its critical infrastructure role, LINK is a token built on Ethereum, not a coin with its own chain.

USDT (Tether) is the largest stablecoin by market capitalization. It exists across multiple blockchains simultaneously as ERC-20 on Ethereum, TRC-20 on Tron, SPL on Solana, and several other standards. This multi chain deployment is possible precisely because USDT is a token, not a coin. It deploys wherever the issuer decides to create a new smart contract.

USDC (Circle) is the second largest stablecoin and the most regulated. Backed by cash and short term US treasuries, USDC is audited monthly and compliant with financial regulations in the United States. It has become the preferred stablecoin for institutional use cases and cross border settlement.

What Is an ICO and How Does Crypto Fundraising Work?

An Initial Coin Offering is a fundraising mechanism where a project sells newly created tokens to investors in exchange for established cryptocurrency, typically Bitcoin or Ethereum. The concept is analogous to an Initial Public Offering (IPO) in traditional finance, but with far fewer regulatory requirements and investor protections.

The mechanics are straightforward. A team writes a whitepaper describing their project, creates a token via a smart contract, sets a price and supply, and opens a sale window. Investors send cryptocurrency to the project's address and receive the new tokens in return. The project uses the raised funds to build its product.

The appeal is obvious: early access to a project before it reaches public exchanges, typically at a significant discount. If the project succeeds and the token appreciates, early investors see substantial returns. The risk is equally obvious: there is no guarantee that the project will deliver, the tokens will have value, or the team will not disappear with the funds.

The Rise and Fall of the ICO Era

The ICO era peaked in 2017 and early 2018, when billions of dollars flowed into token sales with minimal oversight. Projects raised extraordinary sums on the strength of a whitepaper and a website. EOS raised $4 billion. Filecoin raised $250 million. Tezos raised $232 million. Hundreds of smaller projects raised millions each.

The aftermath was brutal. The SEC began classifying many ICO tokens as unregistered securities. A significant percentage of 2017 era projects either failed to deliver a working product, lost their funds to mismanagement, or were outright fraudulent. Studies published between 2018 and 2020 estimated that more than 80% of ICO projects failed.

The collapse of the ICO market did not eliminate token fundraising. It forced it to evolve into models that addressed the structural weaknesses of the original format.

Modern Fundraising Methods in 2026

The mechanisms that replaced traditional ICOs reflect lessons learned from the 2017 era.

IDOs (Initial DEX Offerings) launch tokens directly on decentralized exchanges, providing immediate liquidity from day one. Investors can buy and sell the token as soon as it goes live, eliminating the lockup periods and centralized control that defined ICOs. The tradeoff is volatility: IDO tokens often experience extreme price swings in the first hours and days after launch.

Launchpads are curated platforms, often operated by centralized exchanges, that vet projects before offering their tokens to users. Platforms like Binance Launchpad and similar services conduct due diligence, verify team credentials, and audit smart contracts before listing a project. This adds a trust layer that raw ICOs never had, though launchpad approval is not a guarantee of project success.

Airdrops and points programs have become the dominant distribution method in recent cycles. Instead of selling tokens directly, projects reward early users who interact with their protocol during a testing or early adoption phase. Users earn points based on transaction volume, feature usage, or community participation, and those points convert to tokens when the project officially launches. This model builds genuine user engagement before the token exists, reduces securities law exposure, and creates a community of holders who have actually used the product.

Venture funding with token warrants has replaced ICOs at the institutional level. Projects raise private capital from venture firms in exchange for equity plus token allocation rights. The tokens vest over multi year schedules, aligning investor incentives with long term project success rather than short term price speculation.

How to Evaluate Any Token Sale

Whether a project raises funds through an IDO, a launchpad, or a private sale, the evaluation framework remains consistent.

First, examine the team. Who is building this? What is their track record? Are identities public and verifiable? Anonymous teams are not automatically fraudulent, but they carry higher risk because accountability mechanisms are weaker.

Second, read the whitepaper and technical documentation. A project that cannot clearly explain what it builds, how it works, and why existing solutions are insufficient is either too early stage or too unfocused to deserve capital.

Third, check the tokenomics. What percentage of the supply goes to the team, investors, and community? What is the vesting schedule? Projects where insiders hold 50% or more of the supply with short vesting periods create significant sell pressure risk after unlocks.

Fourth, verify the smart contract. Has the token contract been audited by a reputable security firm? Are the audit results public? Unaudited contracts carry smart contract risk that can result in total loss of funds.

Fifth, assess the regulatory posture. Is this token likely to be classified as a security in major jurisdictions? Projects that ignore regulatory compliance may face enforcement actions that destroy token value regardless of the technology's quality.

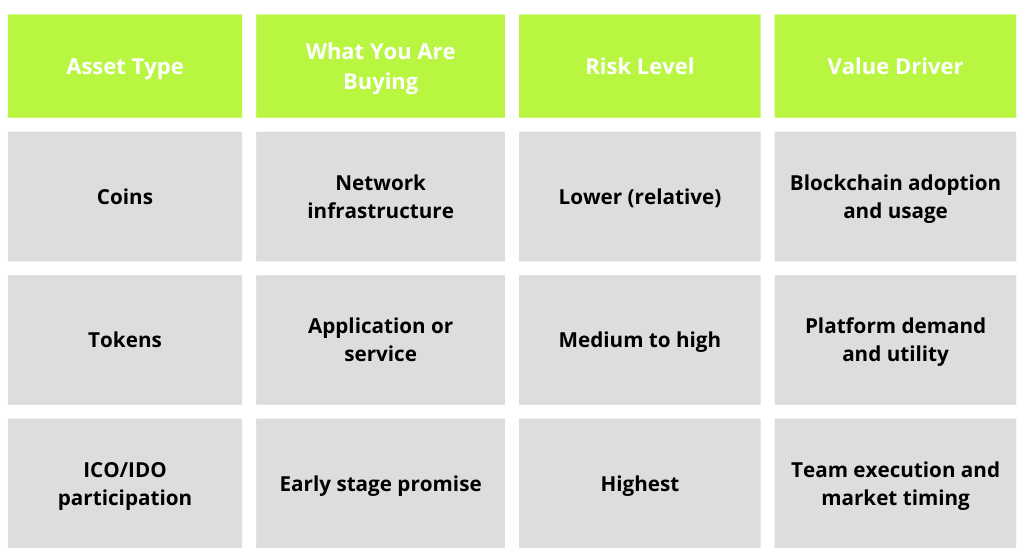

How Coins, Tokens, and ICOs Fit Together

The relationship between these three concepts forms the architecture of the crypto economy.

Blockchains create the infrastructure. Coins power those blockchains. Tokens build applications on top of them. And fundraising mechanisms like ICOs, IDOs, and airdrops provide the capital and distribution needed to get projects from concept to product.

An investor who understands this hierarchy can make more informed decisions. Buying ETH is a bet on the Ethereum network's continued relevance as the dominant smart contract platform. Buying UNI is a bet on Uniswap's ability to maintain its position as the leading decentralized exchange. Participating in an IDO is a bet on a team's ability to execute a vision that may not yet have a working product.

Each level carries different risk and different potential reward. Coins tend to be more stable because they are tied to network fundamentals that change slowly. Tokens are more volatile because they depend on application level adoption that can shift quickly. Early stage token sales carry the highest risk because the product may not exist yet, but they also offer the largest potential upside if the project succeeds.

Practical Investment Framework for 2026

The crypto market in 2026 is more regulated, more institutional, and more complex than it was five years ago. The strategies that worked during the ICO boom of 2017 or the DeFi summer of 2020 do not necessarily apply today.

Core holdings should be coins. Bitcoin and Ethereum represent the most battle tested networks with the deepest liquidity, the broadest institutional adoption, and the most robust security models. These are the assets you hold through cycles because their survival is tied to the survival of the entire industry.

Growth positions can include tokens that serve clear utility within established or emerging ecosystems. Governance tokens of protocols with genuine revenue, stablecoins for capital preservation and yield, and infrastructure tokens like LINK that provide essential services to the broader ecosystem all represent different risk and reward profiles.

Early stage participation through IDOs and airdrops should represent a small allocation with high conviction. The due diligence requirements are substantial, the failure rate is high, and the potential returns can be extraordinary. Never allocate money you cannot afford to lose entirely, and always verify the fundamentals before the hype.

Diversification across categories provides structural resilience. A portfolio that holds only coins misses application level growth. A portfolio that holds only tokens is overexposed to smart contract risk and application specific failure. A balanced approach captures value across the entire stack.

The single most important thing an investor can do is understand what they own. A coin is not a token. A token is not an ICO. And none of them are guaranteed to appreciate. The investors who perform best over full market cycles are the ones who know exactly what they are holding, why they are holding it, and what would need to change for them to sell.

Disclaimer: This article is educational content published by Genesis Bytes. It does not constitute financial or investment advice. Cryptocurrency investments carry substantial risk. Always conduct your own research before investing in any digital asset.